Free Accounting Software*

Simplify the Accounting Process of Your Small Business OperationsMake tracking Invoices, Customer Payments, Business Expenses and bank transactions simple with Database Providers small business accounting software.

Accounting Software Core Features

Manage and track invoices, expenses, income, bank transactions seamlessly within a unified platform, improving efficiency and consistency.

- Navigation

- Vendors / Suppliers

- Chart Of Accounts

- Customers

- Invoices

- Receipts

- Bills / Expenses

- Payments

- General Ledger

- Journal Entries

- Banking

- Credit Cards

- Employee Time Cards

- Reports

- Software Requirements

- Qualifications of Free Version

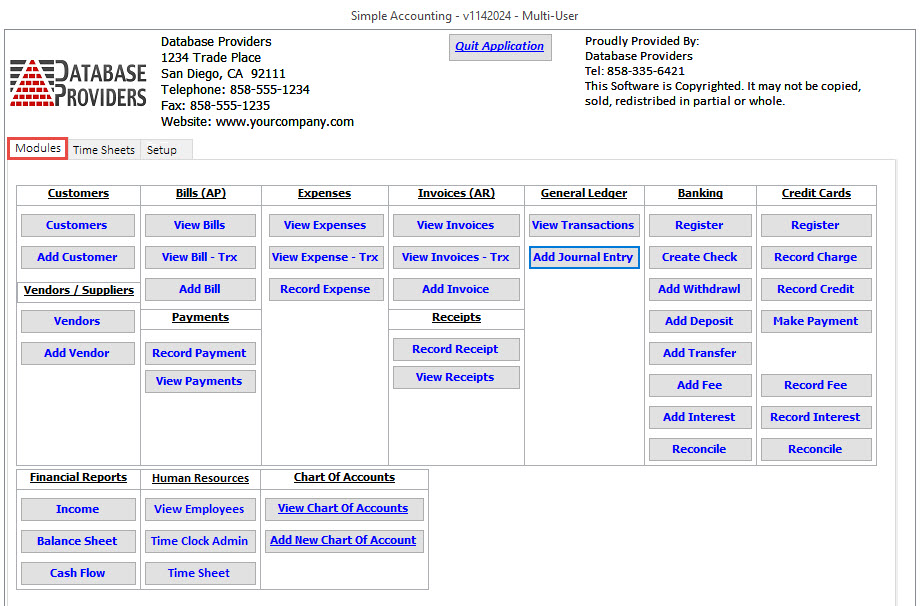

Simple Navigation

- Main Menu By Module providing one click access to the Area of Interest

- Quick Access to Real-Time Time Sheets and Software Setup and Defaults

| Book A Demo | More Details |

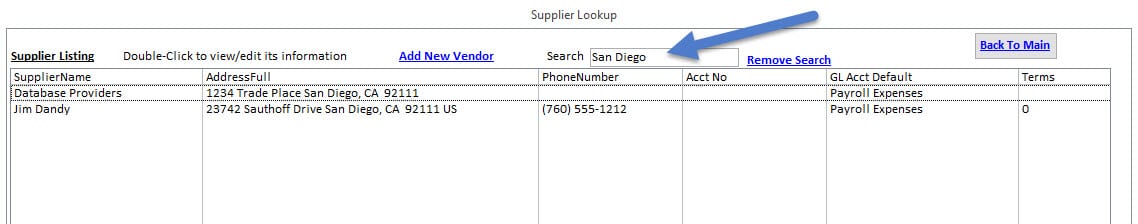

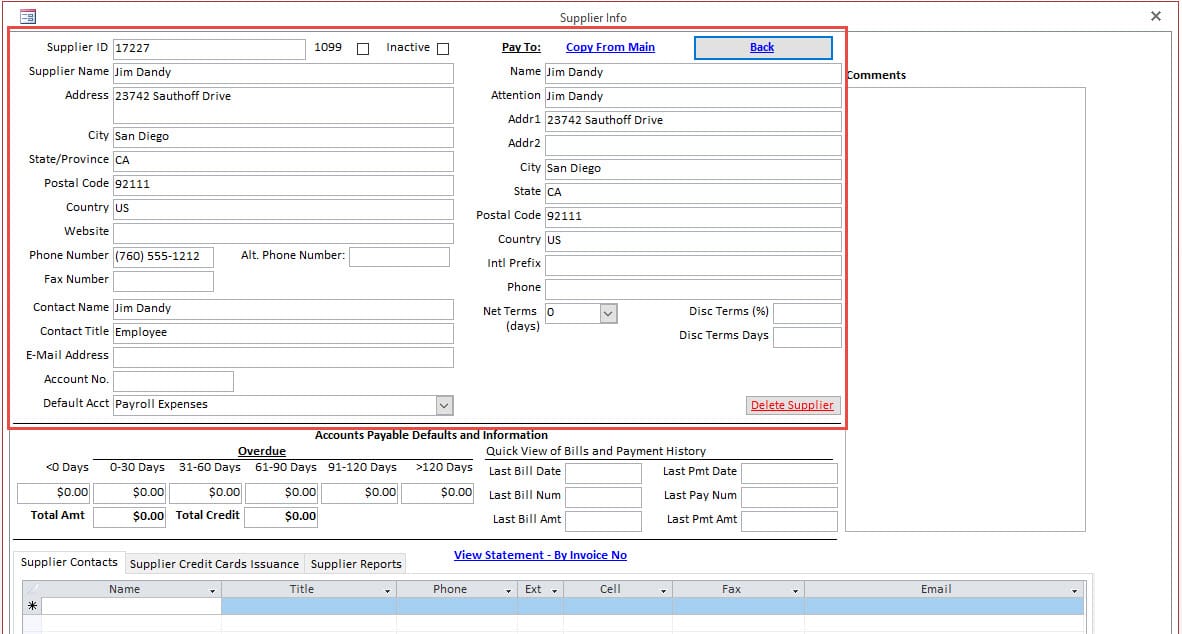

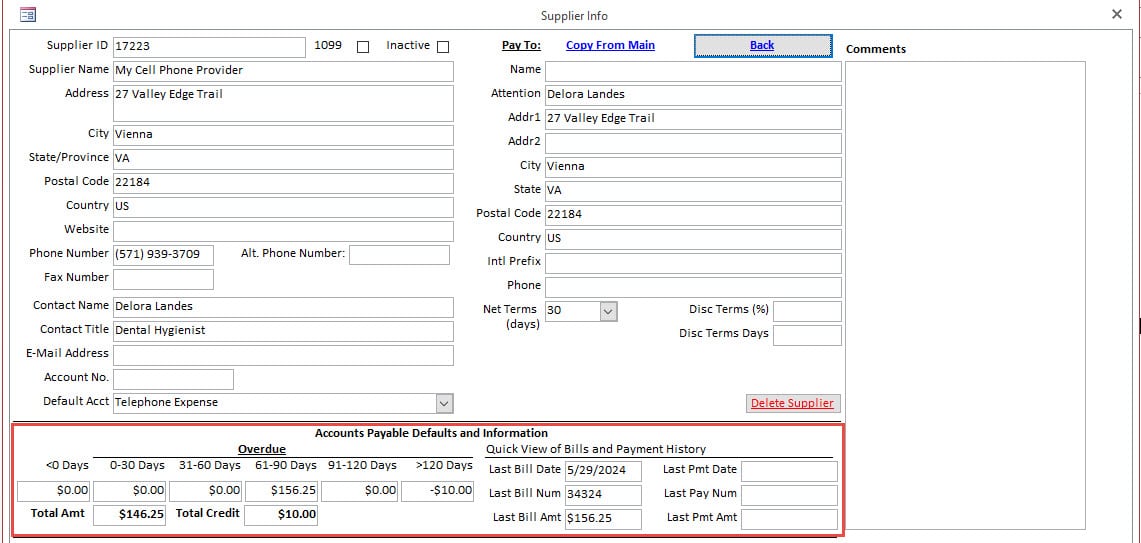

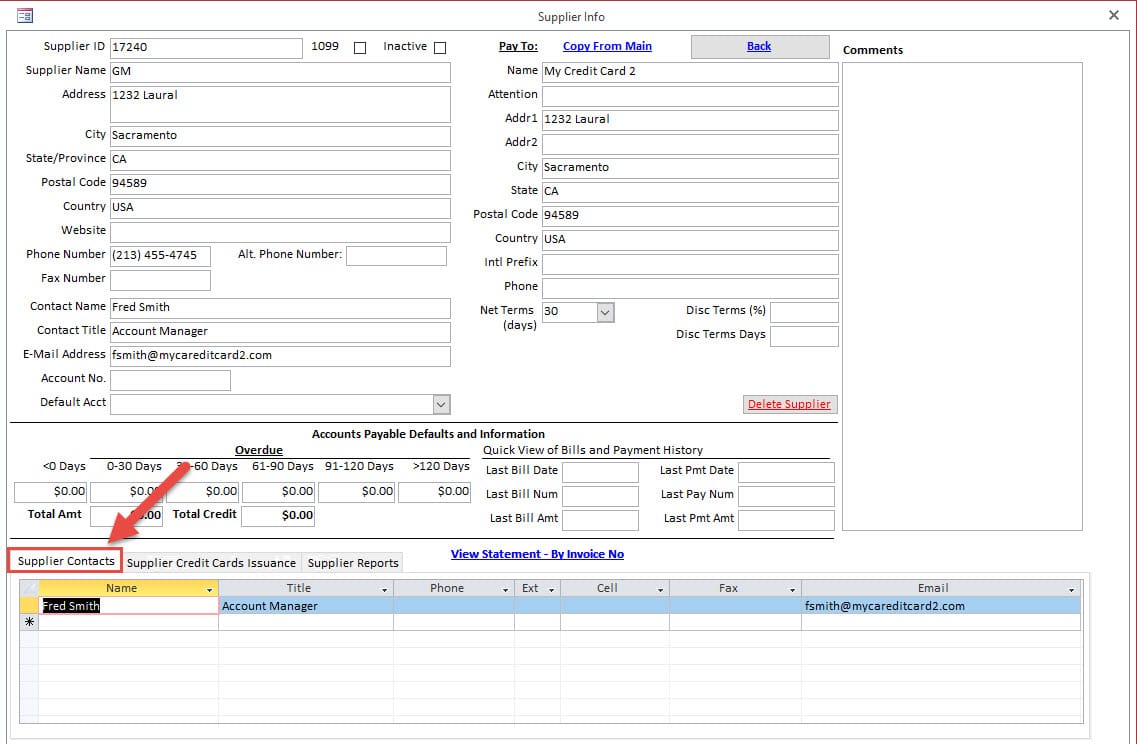

Manage Vendors or Suppliers

Seamlessly create and manage vendors or suppliers for enhanced accounting

- Easily manage Vendor Locations and Pay To Addresses

- Manage Unlimited number of Vendor Contact Information

- Real-time Accounts Payable view and Most Recent Bill and Payment Transactions

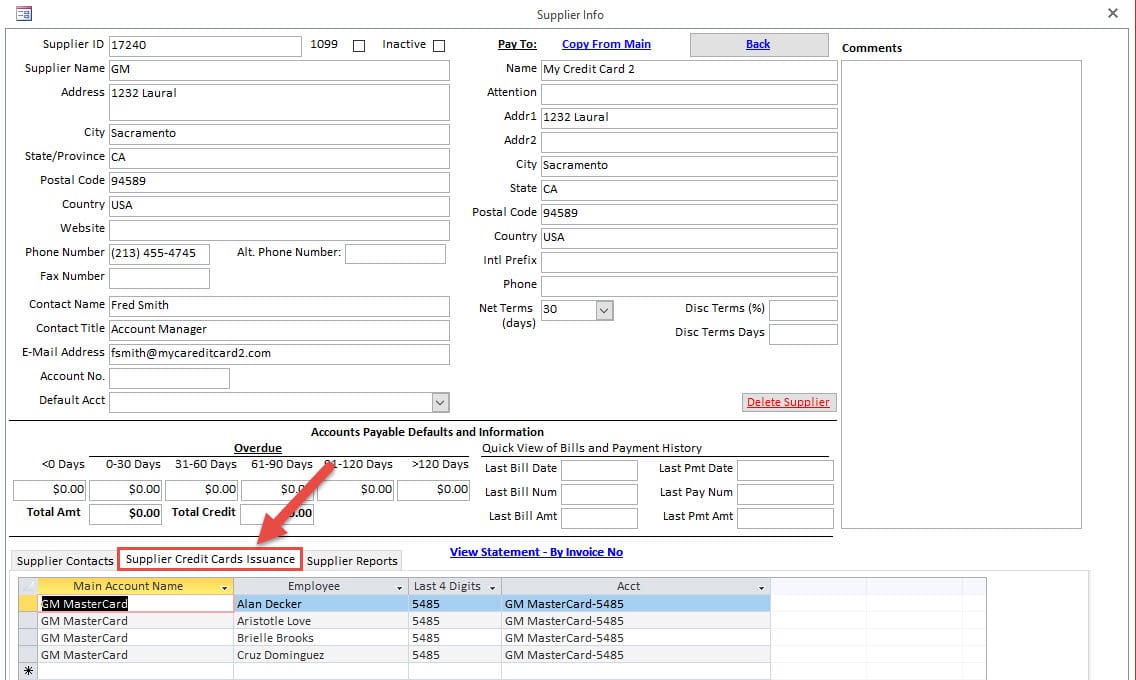

- Effortlessly manage Credit Card Accounts Issued by Suppliers

- Quickly Search and Find Suppliers using Easy to Use Filter Options

| Book A Demo | More Details |

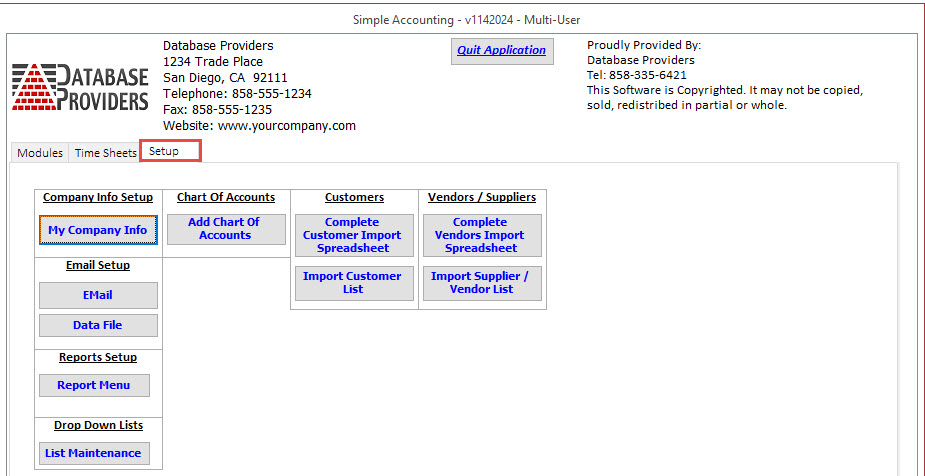

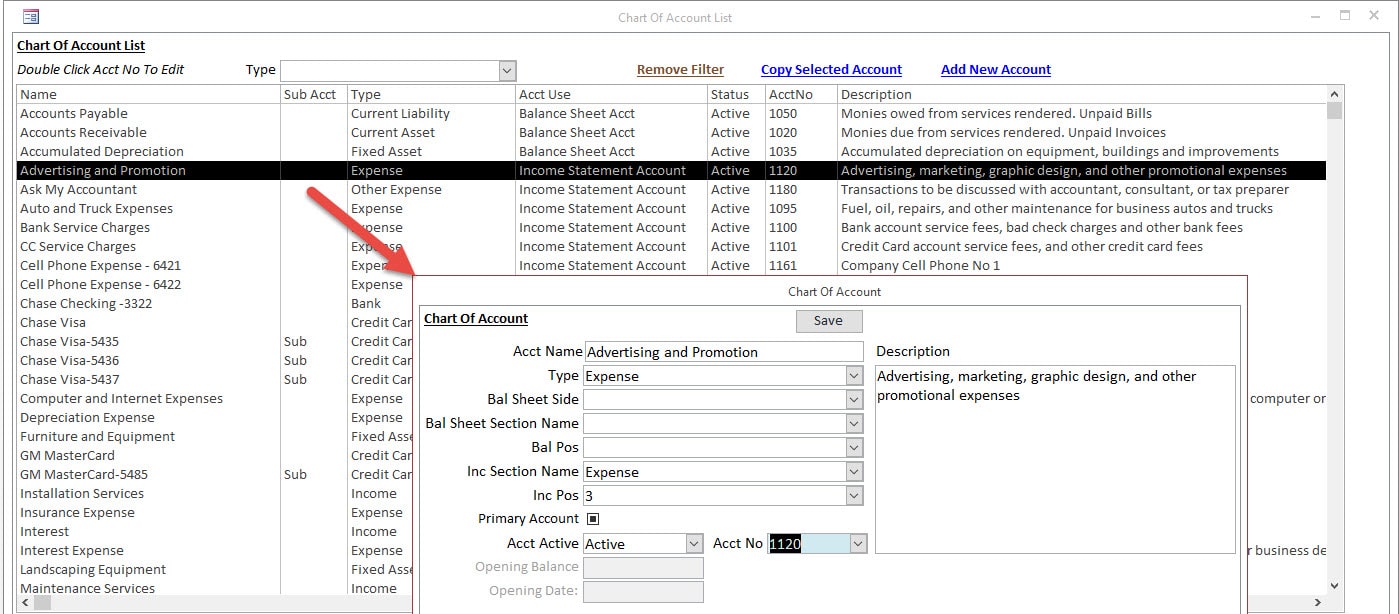

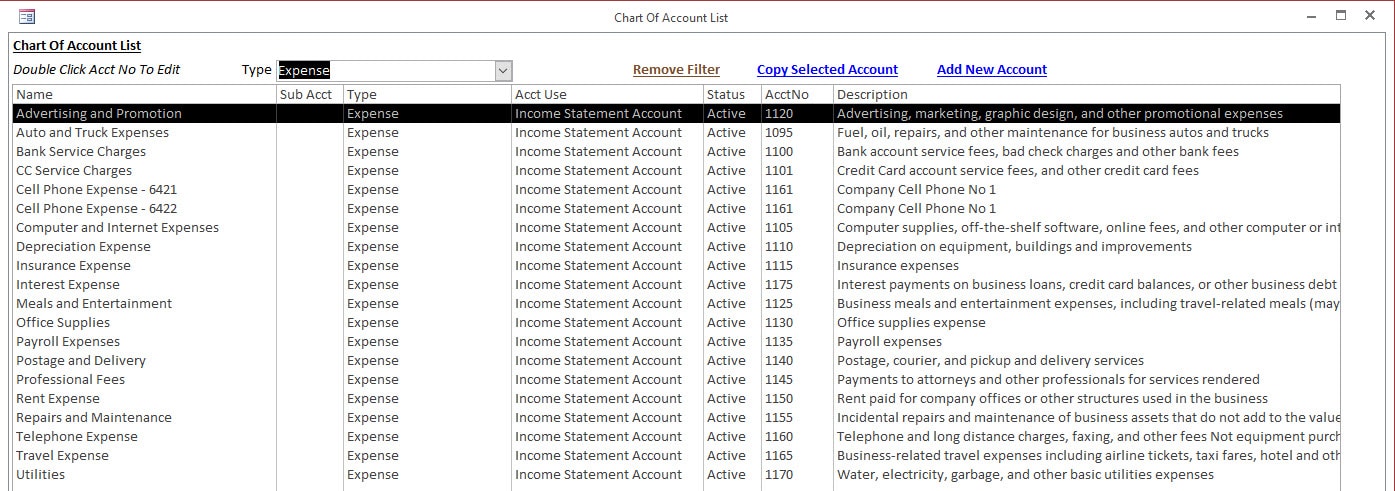

Manage Chart of Accounts

Easily create and manage chart of accounts for enhanced and detailed accounting

- 100s of Industries to Choose From along with Business Type to Establish Default Set of Chart of Accounts

- Create Additional Accounts as needed.

- Easily Search Existing Chart of Accounts by Type.

| Book A Demo | More Details |

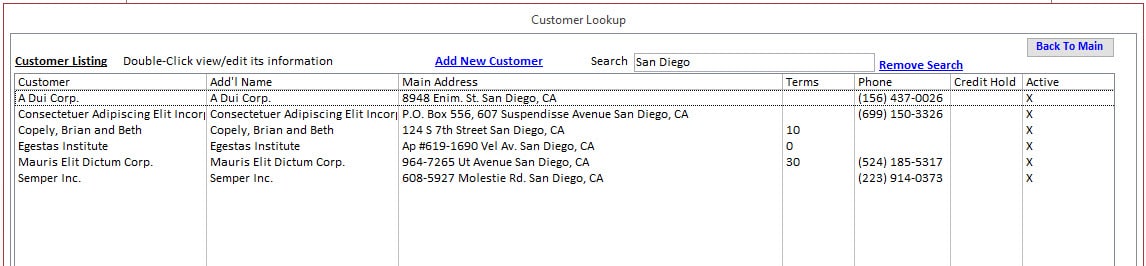

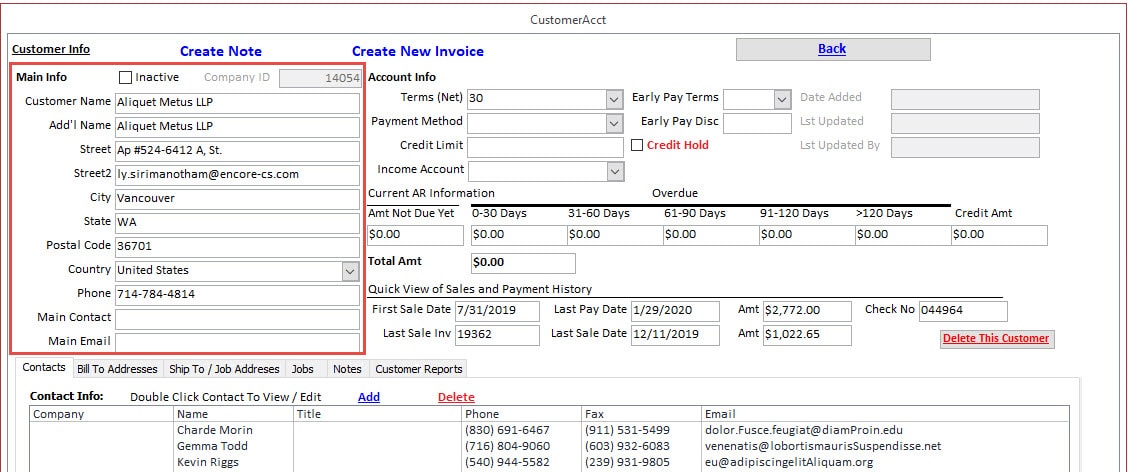

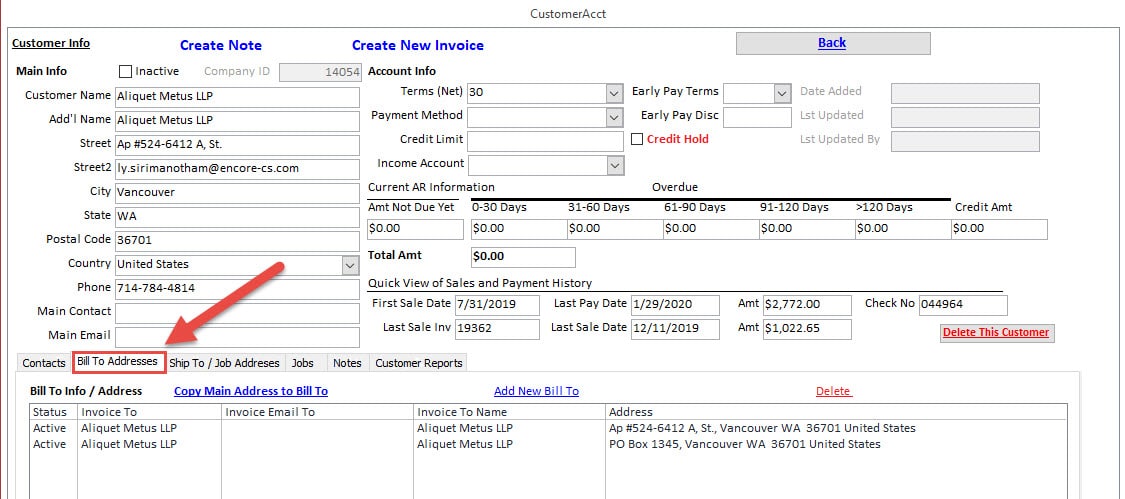

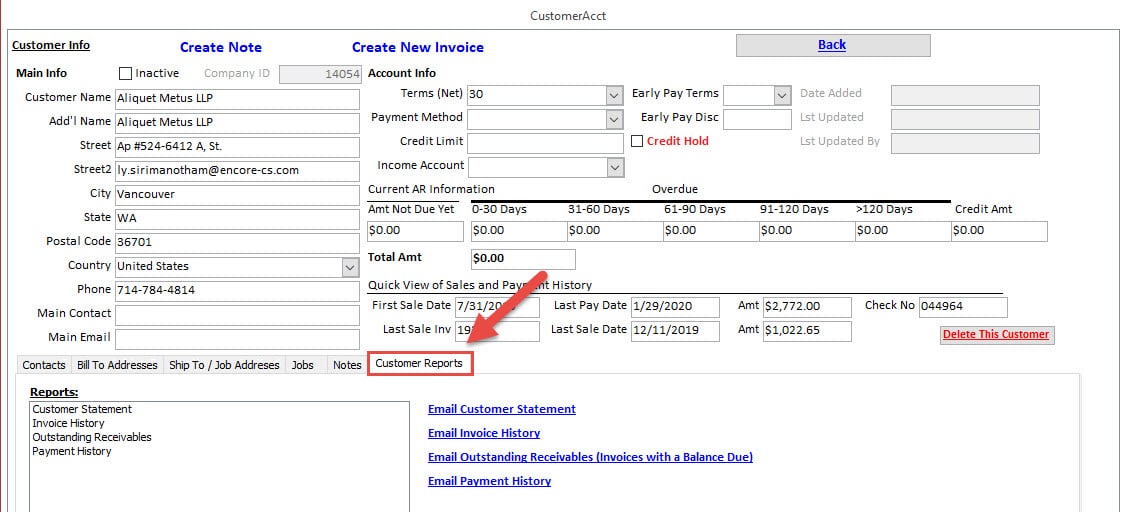

Customer Information

Define and Categorize your Customers with our comprehensive description fields.

- Quickly Search and Find Customers using Easy to Use Filter Options.

- Easily manage Customer Main Facility Location.

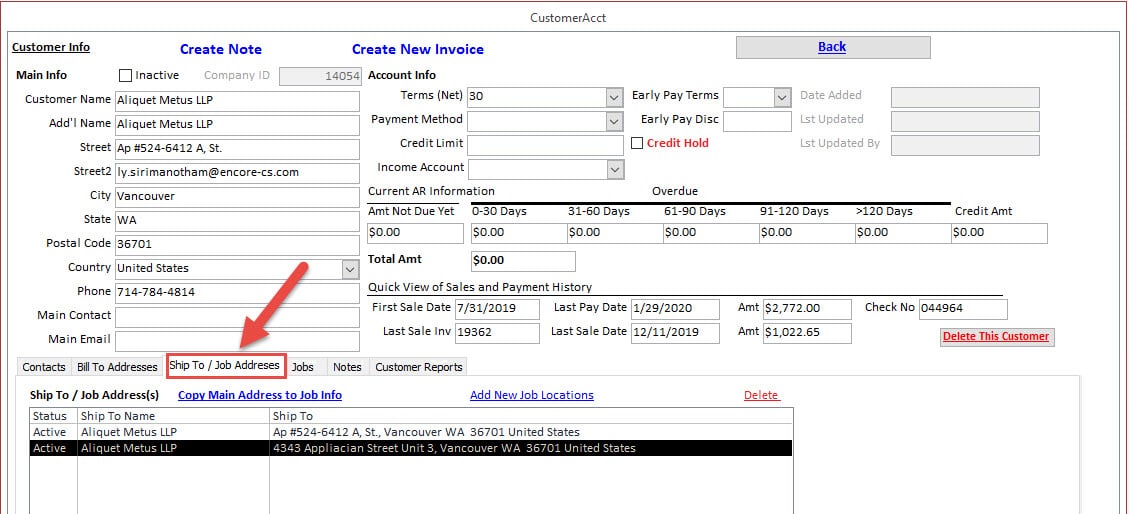

- Easily manage Multiple Customer Bill and Ship Locations.

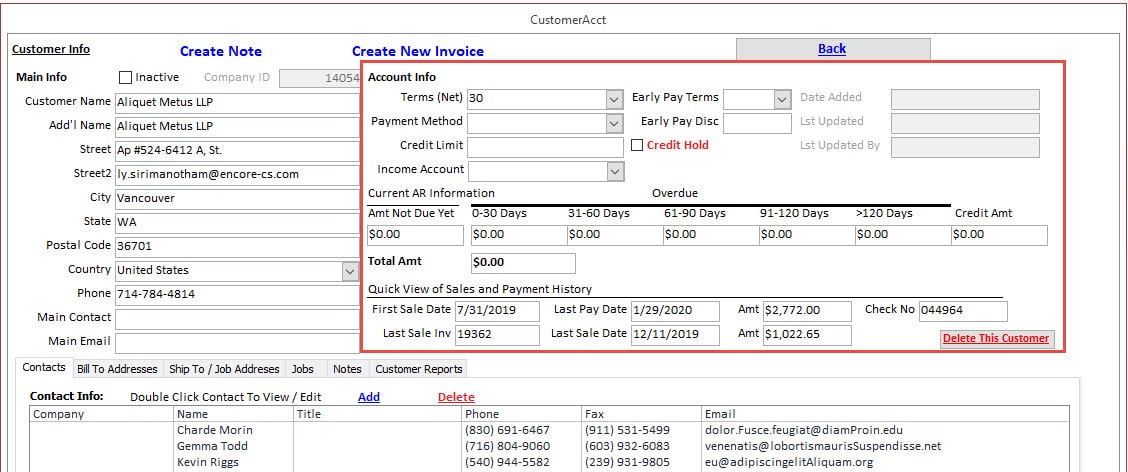

- Real-time Accounts Receivable view and Most Recent Sale and Receipt Transactions.

- Effortlessly manage Payment Terms, Credit Limits and Default Income Account.

- Quickly Search and Find Suppliers.

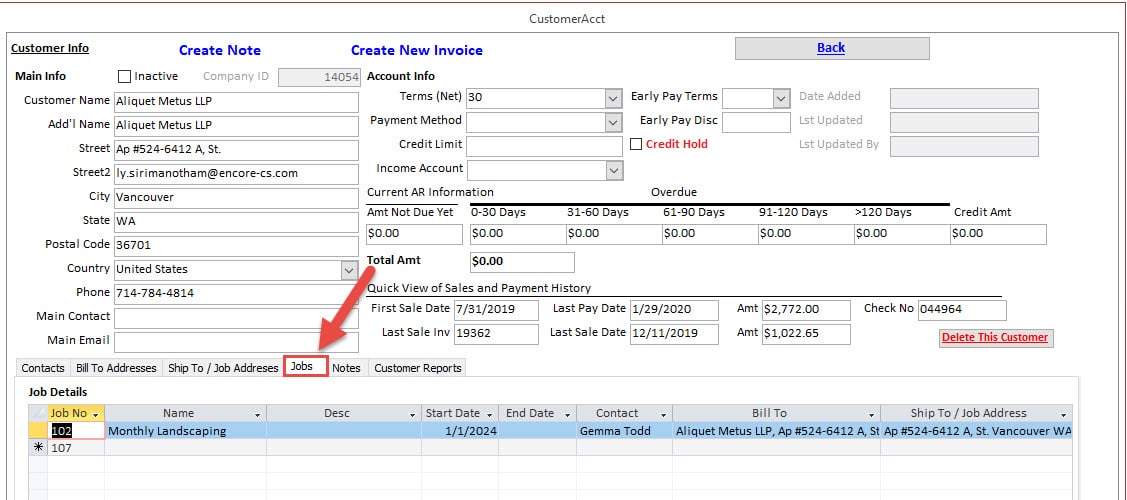

- Create and Manage Job Numbers for Each Customer.

| Book A Demo | More Details |

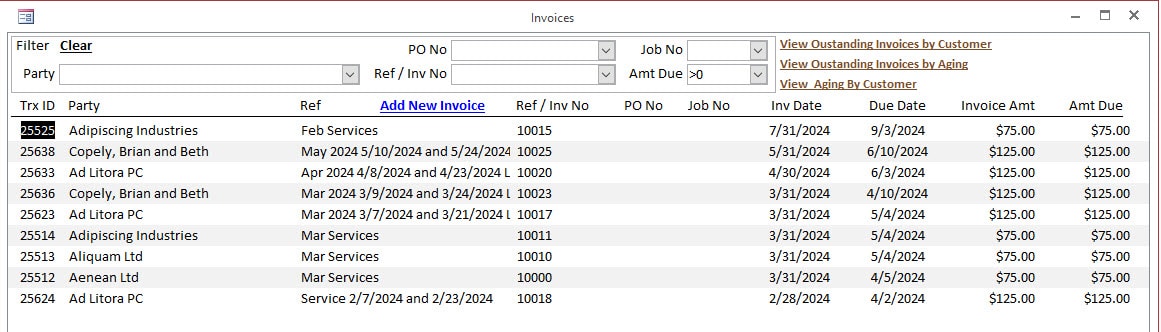

Simple, quick creation of Invoices for flawless tracking.

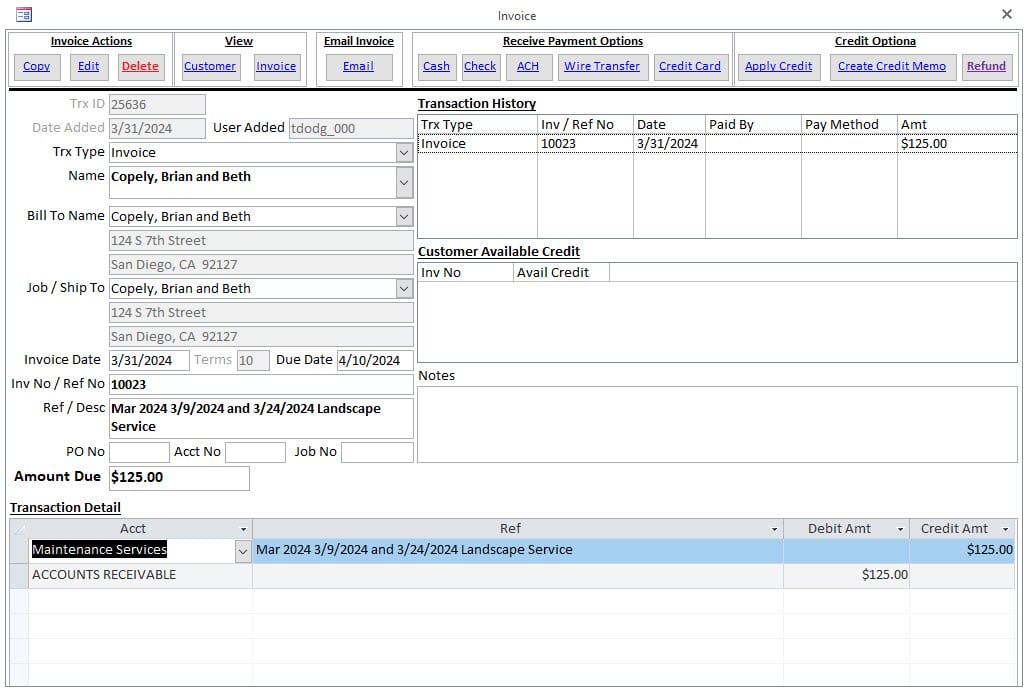

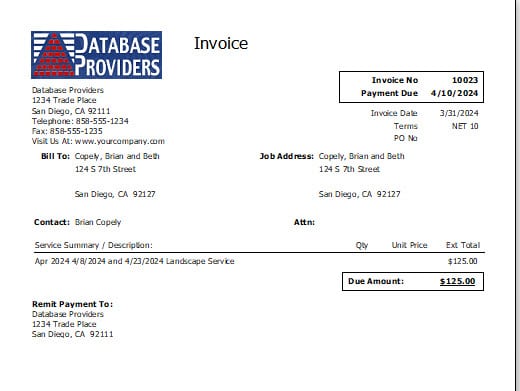

Clearly identifying Customer, Bill To Address, Payment Due Date, Invoice Number, and Payment Amount, line item description of service or product, quantity, unit price, and tax.

- Provides a historical record for GAAP compliance and auditing purposes.

- Effortlessly create Invoices with a few clicks.

- Automates the emailing of Invoices to Customers with a single click.

- Add Job Numbers into Invoices to easily track Job Profitability.

- Search and Find Invoices by using Comprehensive Filter Options.

- One click to show Invoices With Balance

- One Click to Email Invoice Due Reminders

| Book A Demo | More Details |

Receipts (Customer Payments)

Viewing Receipts is Simple and Efficient using the Comprehensive Seach Filters.

- Receipt Transactions are all created automatically when recording Receipts (Payments made by Customer) against Invoices.

- Receipts Entered From Invoice or Through the Batch Receipt process.

| Book A Demo | More Details |

Bill and Expense Management

- Provides a historical record for GAAP compliance and auditing purposes.

- Effortlessly create Bill with a few clicks.

- Skip the Bill process, and Effortlessly record Expenses with a few clicks.

- Add Job Numbers into Bills or Expense transactions to easily track Job Profitability.

- Search and Find Bills and Expenses by using Comprehensive Filter Options.

- One click to show Bills With Balance

| Book A Demo | More Details |

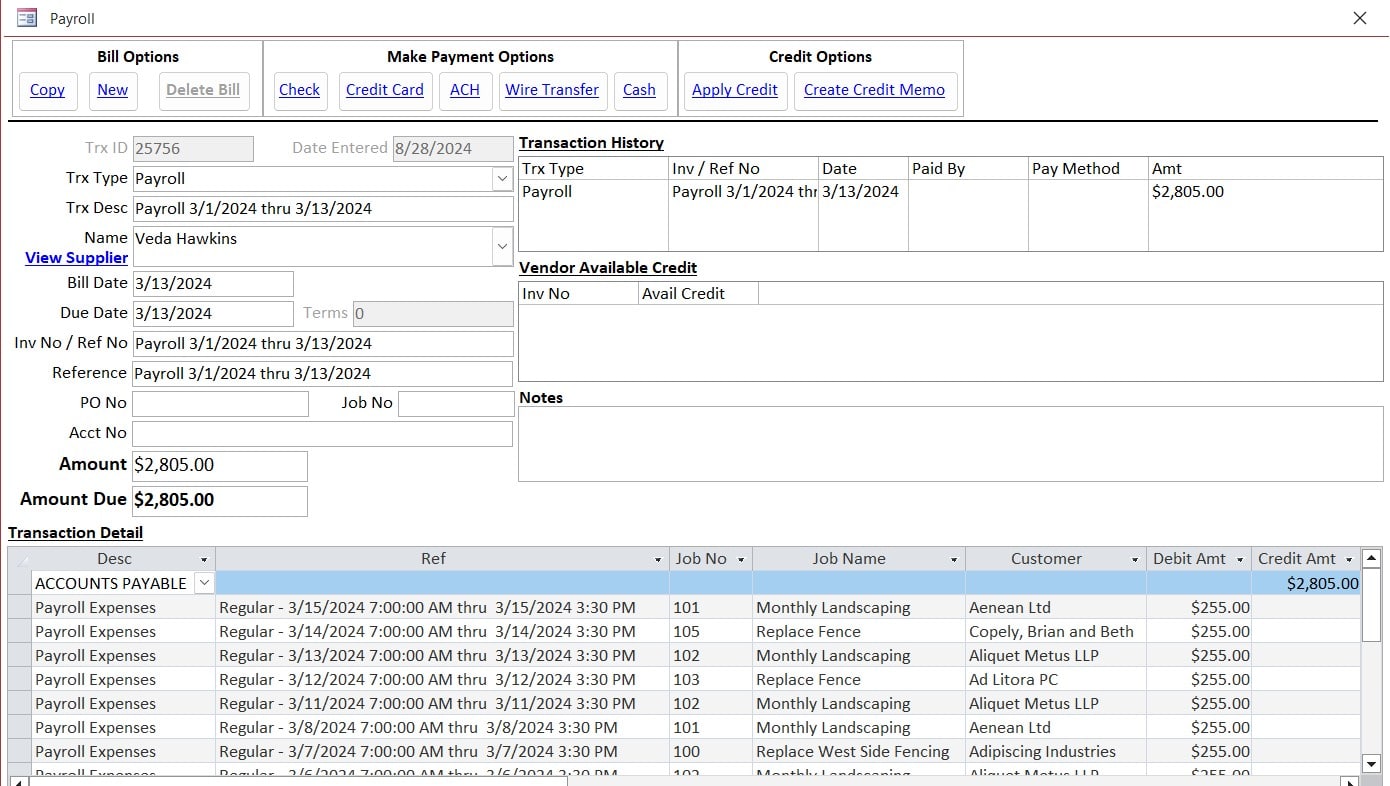

Payments (Payments Towards Bills)

Viewing Payment is Simple and Efficient using the Comprehensive Seach Filters.

- Payment Transactions are all created automatically when recording Payments Towards Bills.

- Payments Entered From Bill or Through the Batch Payment process.

| Book A Demo | More Details |

View All Accounting Transactions with ease!

- Comprehensive Filtering Options lets you find any Accounting Transaction Effortlessly.

- See the complete Credit and Debit Entries of Each Transaction Added.

- General Ledger or Journal Entries for recording transactions for Fixed Asset Depreciation, Payroll, Payroll Liabilities, Adjustments, etc.

| Book A Demo | More Details |

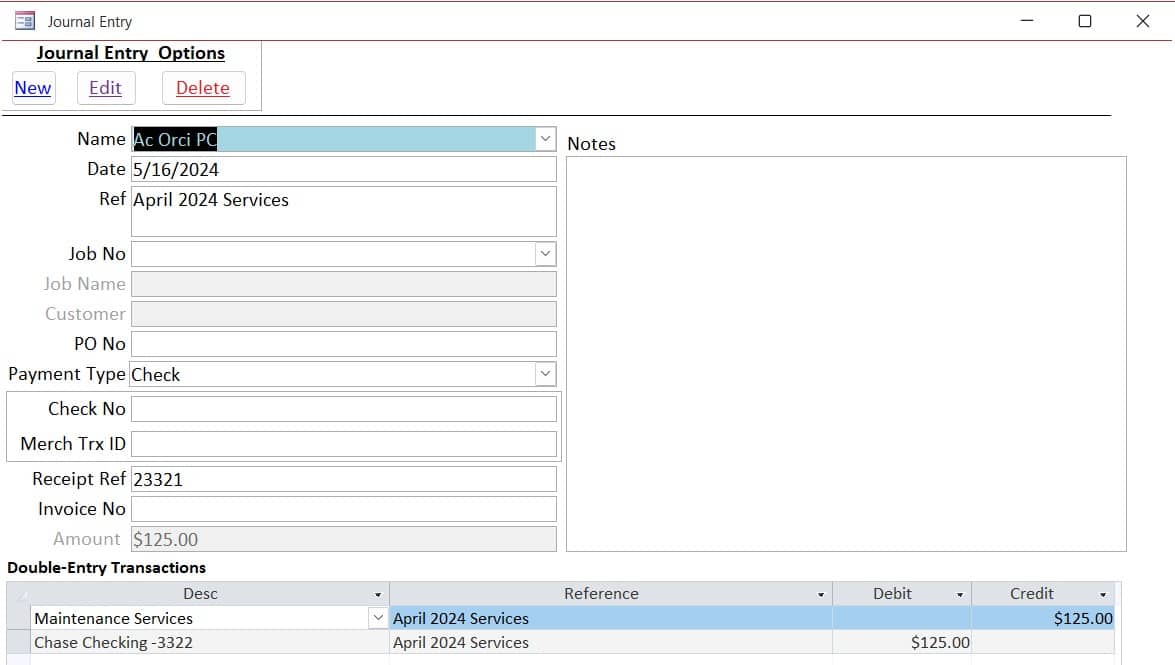

Enter Journal Entries Effortlessly.

- Every Type of Business Transaction can be added as a Journal Entry.

- Since this Software uses Double-Entry Accounting, Each Journal Entry requires a Credit and Debit.

- Typical Journal Entries record transactions for Fixed Asset Depreciation, Payroll, Payroll Liabilities, Adjustments, etc.

| Book A Demo | More Details |

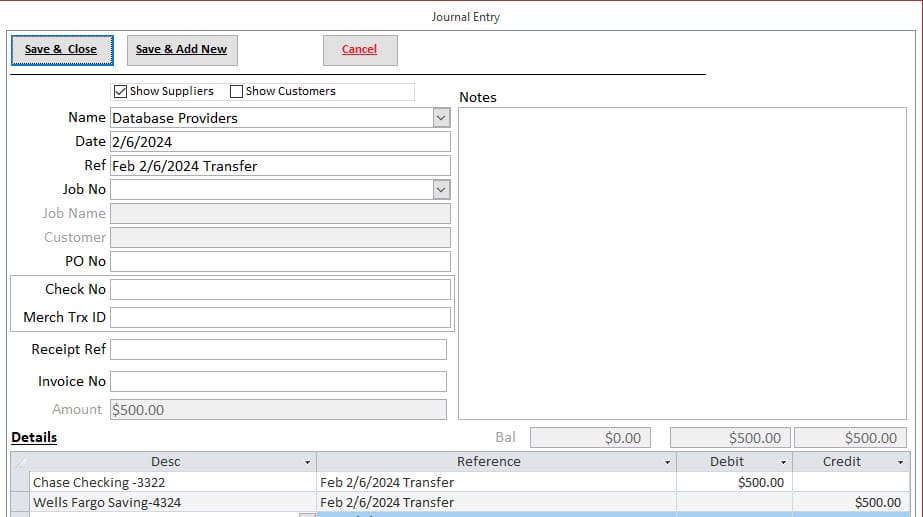

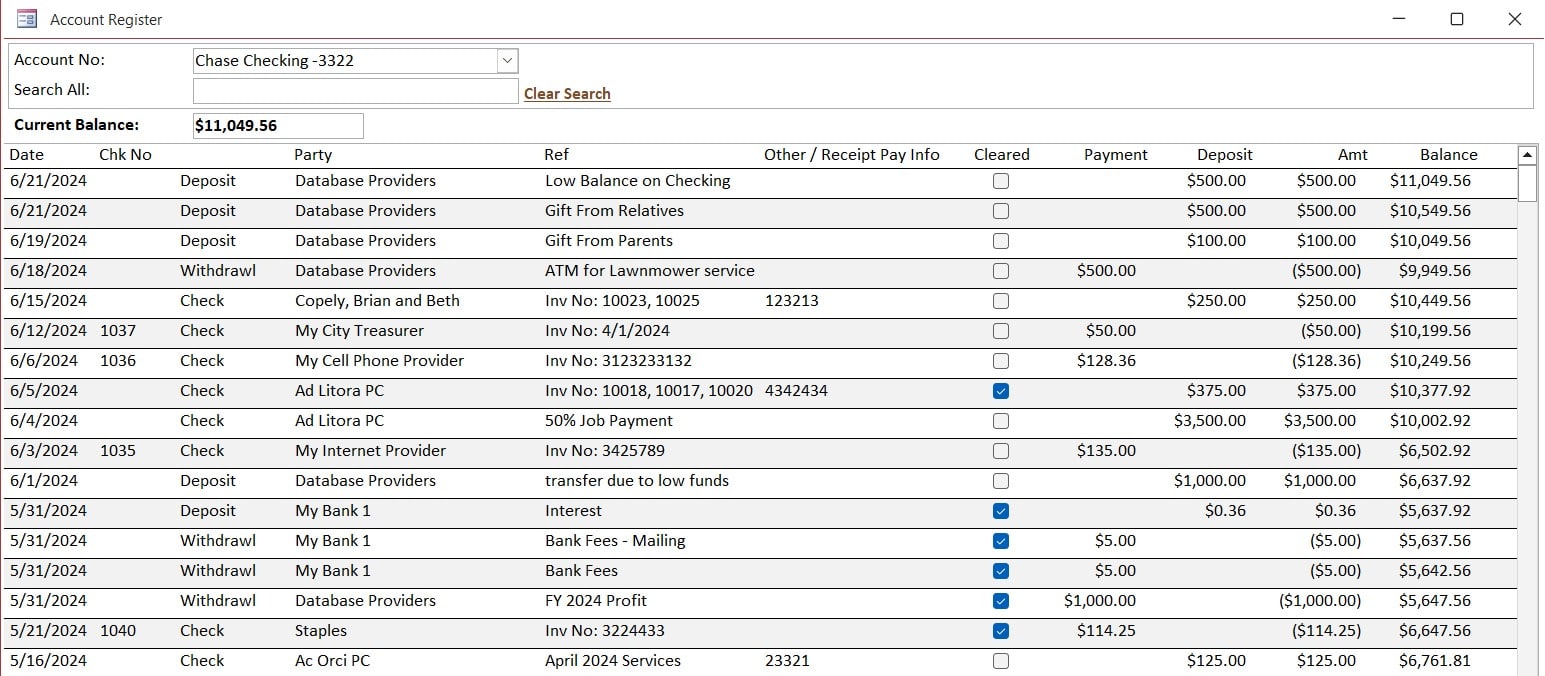

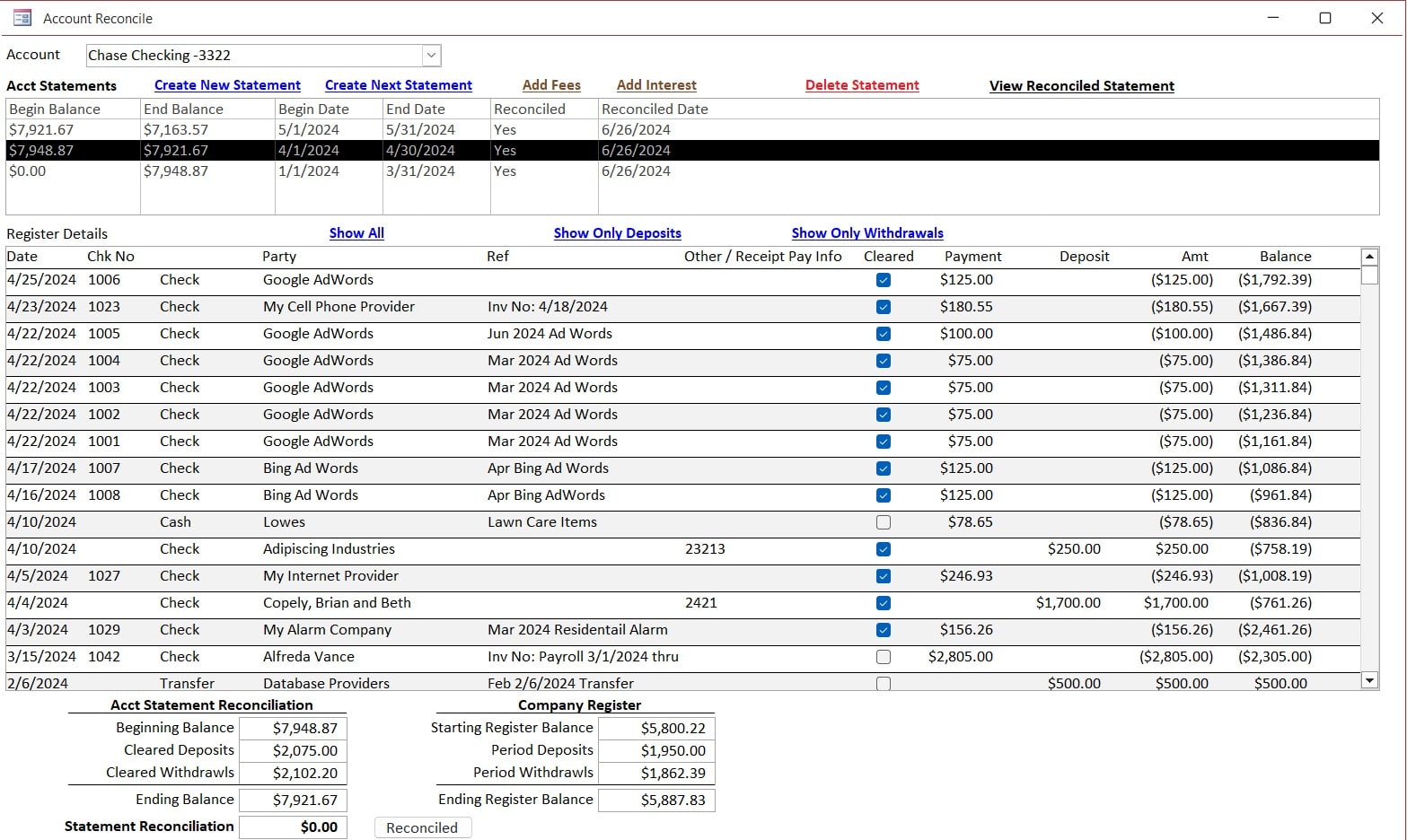

Bank Account Management

Effortlessly record Bank Deposits and Withdrawals.

- Automatic Bank Account Tranasaction entries for Invoice Receipts and Bill Payments.

- One Click solution for Bank Deposits, Withdrawals, Transfers and Bank Fees.

- View Bank Register with Ease using Comprehensive Filtering to Find Transactions of Interest.

- Effortlessly Create Checks with option to Print Checks.

- Easily Complete Bank Account Reconciliation Process.

- Comparing the Banks’ Account Statement Balance with Bank Account Register is critical in any Accrual Basis Accounting Software.

| Book A Demo | More Details |

Effortlessly track and manage Credit Card Transactions, Purchases and Payments.

- Manage Credit Card Account and Owner through Supplier Record.

- Easily Record Credit Card Purchases.

- Effortlessly Add Credit Card Credits and Returns.

- One Click to View Credit Card Register with Balance.

- One Click to Record a Card Card Payment.

- Simple Process to Reconcile Credit Card Accounts including adding Interest Charges and Other Fees.

| Book A Demo | More Details |

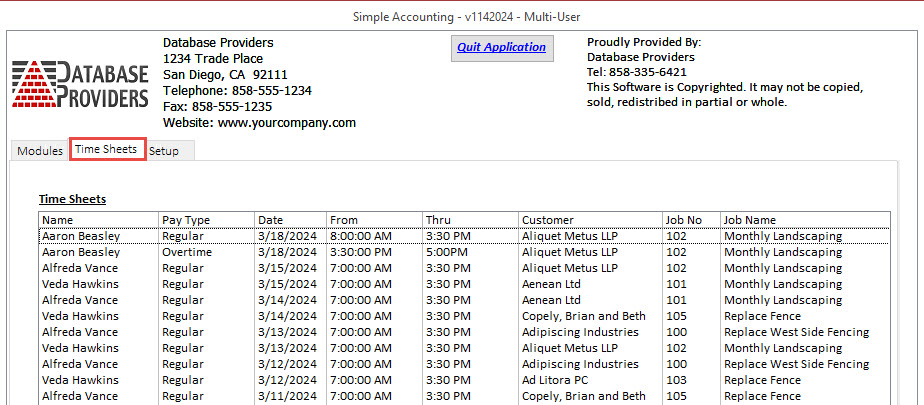

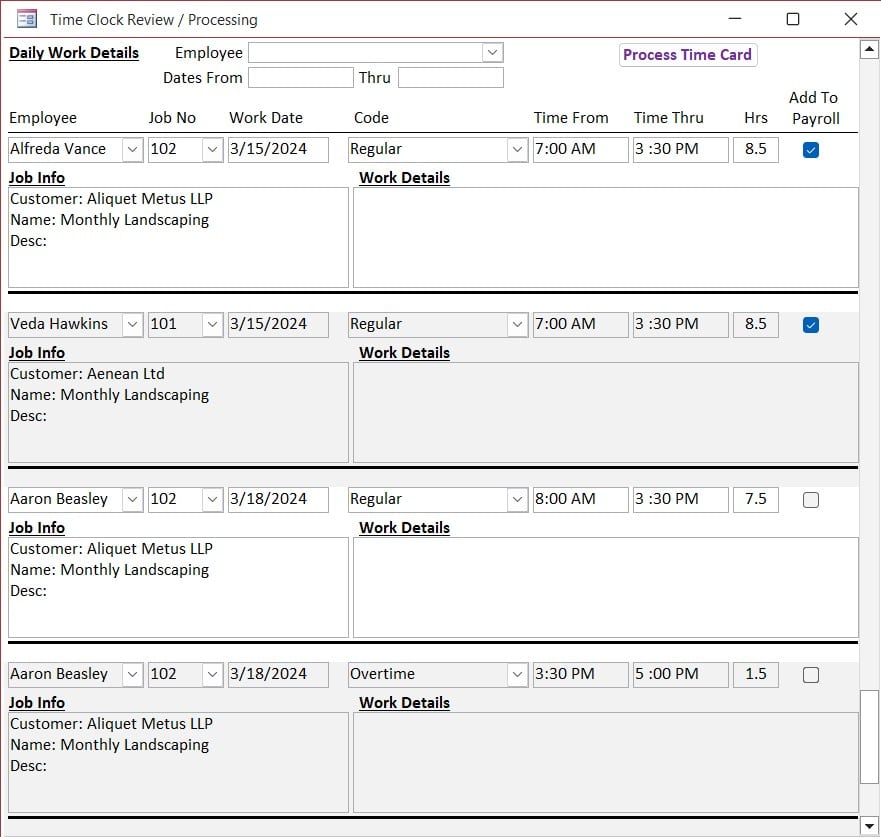

Employee Time Card and Labor Tracking Management

Effortlessly track and manage Employee Time Cards

- Record Employee, Work Date, Start and End Times.

- Link Work Duration to Job Numbers to seamlessly capture Labor Hours per Job.

- Manage Pay Types such as Regular, Over Time, Double Over Time, Holiday, Jury Duty, Bereavement, Vacation, Sick, PTO, Unpaid Absence, etc.

- Easily Review and Process Employee Tim Cards and Process for Payment.

- One Click to Create Employee Payroll Checks.

| Book A Demo | More Details |

Robust Reports for Every Aspect of the Small Business

- Accounts Payable (AP)

- Bills By Vendor, Aging, Job Number.

- Available Vendor Credits

- Account Receivable (AR)

- Invoices By Customer, Aging, Job Number.

- Available Vendor Credits

- Expenses

- Vendor, Paid Account, Expense Account, Date, Job Number

- Banking

- Transactions by Account Number,

- Bank Statement,

- Bank Reconciliation

- Credit Card

- Transactions by Account Number,

- Credit Card Statement,

- Credit Card Reconciliation

- Financial Statements

- Income Statement,

- Balance Sheet,

- Cash Flow

- Time Sheet / Card –

- Employee,

- Pay Types,

- Payroll Period

- Job Number

- …and many more!

| Book A Demo | More Details |

Accounting Software Computer Requirements

- Windows Operating System, Windows 10 or higher

- Microsoft Access 2007 or higher, 32 or 64-bit

- Microsoft Outlook Email Application (recommended, but not required)

| Book A Demo |

Requirements of the Free Version

- Must supply full Business Name, Address, Contact Information and Email Address.

- USA-Based Businesses Only.

- Acceptance of our Release of Liability for using this Software.

- Acceptance of our Terms and Conditions of Use.

| Contact Us |

See This Accounting Software In Action

Bills and Recording Payments (Account Payables)

These videos explain Account Payables, or Bills, and demonstrates the effortless process to enter and copy bills, and the simplicity of recording a Payment to a Single Bill and how to apply a Single Payment to Multiple Bills.

In addition, once payments are entered, there are options for viewing the payments and what bills the payment was applied to.

Invoices and Recording Customer Payments

The Invoice process in DP Accounting Software is simple. Many Businesses create and send out Invoices to Customers for goods or services rendered. Managing Invoices and the Payments made to them is essential. These videos talks about Business Invoices and demonstrates how invoices are created, copied, deleted, and even emailed using a single click operation in the DP Accounting Software. It also demonstrates how to search and find existing Invoices and preview Invoices in the PDF format.

Business Expenses

Every Business has Expenses. This video aims to define business expenses and explain different types of Business Expenses through a series of demonstrations.

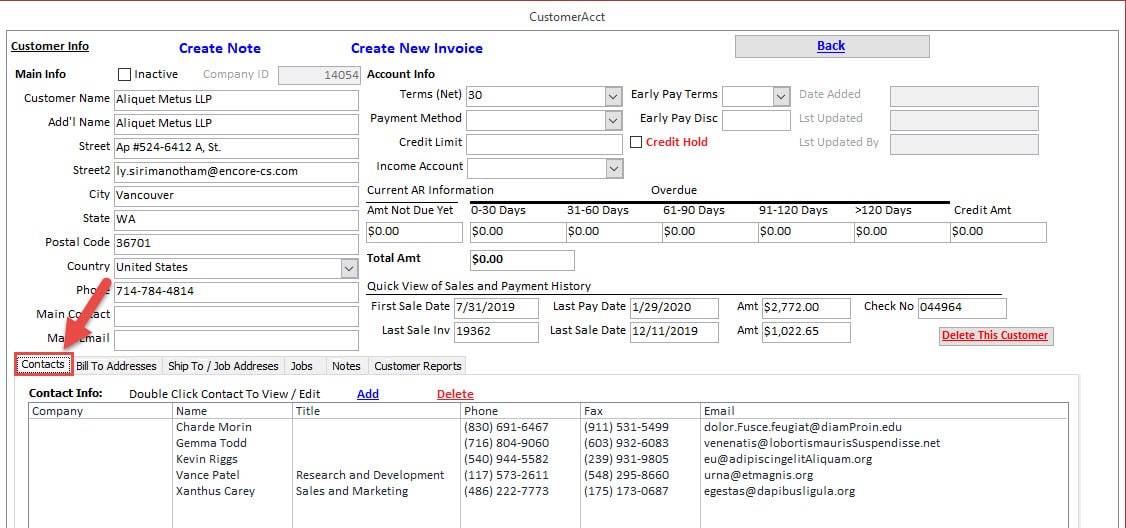

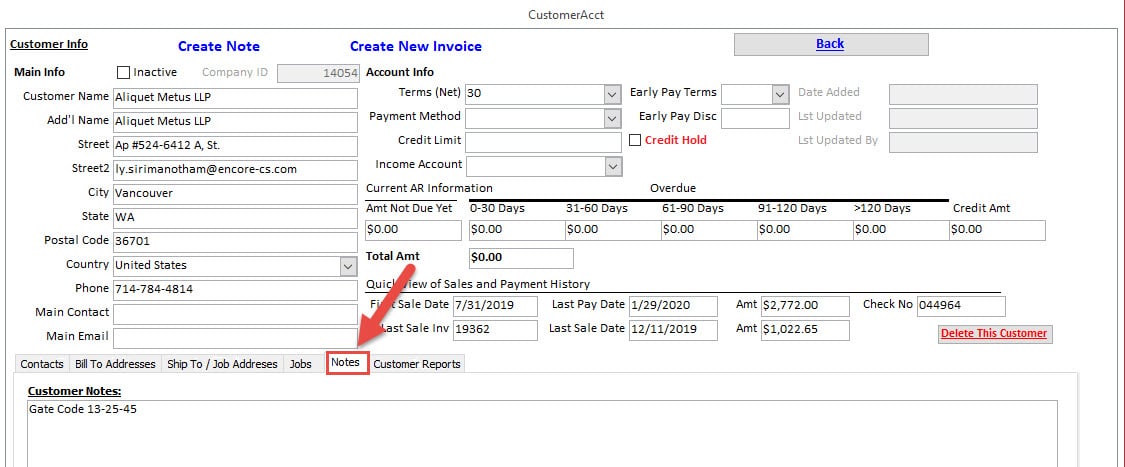

Managing Customers

See how simple managing customers, customer contacts, payment terms, bill to addresses, and job locations.

See various Real-Time, One-Click effort to Show Customers Aging, Invoice and Payment history, and Customer Statements

Managing Suppliers and Vendors

Effortlessly manage suppliers, or vendors, supplier contacts, payment terms, default general ledger account, credit cards and pay to address.

In Addition, view the different Supplier-Related reports such as Supplier Aging, Bill and Payment History, and Supplier Statement

Creating Checks - Banking

See the simplicity of Creating and Printing Checks through the Account Payables or Banking modules.

Deposits, Withdrawals and Transfers - Banking

See how effortlessly it is to record Bank Account Deposits, Withdrawals, and Transfers

Account Register - Banking

See the conveniency of the Account Register as an easy way to view of all transactions linked to a specific Account. Where it be a Bank, Expense, or any other Asset, Liability or Equity Account.

Account Reconciliation

See how simple and easy Account Reconciliation can be with demonstrating the Account Reconciliation process from Beginning to End.

Credit Cards - Purchases

Easily record credit card purchases and make Credit Card Statement Reconciliation process simple. Whether it be recording a payment of Bills, Expenses, Fees or Interest, this Credit Card module makes it easy.

Credit Cards - Recording a Credit

View the simplicity of recording a credit applied to a credit card.

Credit Cards - Payments

View the effortless recording of a Payment made towards a Credit Card Balance, whether partial or full, adding interest and any other fees. It also demonstrates how credit card accounts are set up in the supplier or vendor module and can be assigned to a specific employee.

Credit Card - Account Reconciliation

See the Reconciliation process of Credit Card Statements in action. Entire Process from Creation a new Statement record, clearing the transactions that are included in the Credit Card Statement, adding any missing Charges, Credits, or Payments, adding Credit Card Fees and Accrued Interest.

Time Sheets and Payroll

This video will demonstrate how to record Employee Time Sheets, review the Timecards for accuracy and proper Pay Types, and then process the Time Sheets into Bills and a subsequent Payroll Payment for the Employee at the end of each Pay Period.

Why Choose Us?

Its FREE!

We are offering this Accounting Software to Help Small Businesses Manage their Finances.

Our Goal is to minimize the efforts of bookeeping, so Businesses can focus their efforts on delivering the services or products to sustain and grow their business.

What are you waiting for? See if your Business qualifies for the FREE version of this software.

Real-Time Revenue, Expenses and Profitability

You cannot make up a loss in Volume! Verify your business is Profitable, and if not see why.

Open-Source and Personalization

Customize the software according to your needs.

Customized Invoices

Modify Invoices to Your Needs and Requirements

Automation

Single-Click Emailing of Invoices, Customer Aging Reports and Statements

Simple and Easy Recording of Basic Business Accounting Transactions

Effortlessly Create Invoices and Record Expenses

Simple Navigation

User-friendly interface for all aspects of Accounting – Account Payables, Account Receivables, Banking, General Ledger, Journal Entries, Reporting.

Best-in-Class Customer Service and Support

Experience 100% USA-based support.

Robust Reporting

Generate detailed Financial and Accounting reports and assists in GAAP compliance with detailed records.

Experience the power of a Microsoft Access accounting and financial management application with an intuitive, customizable, and user-friendly interface.

Ready for an Accounting Revolution?

Reach out to us today to discuss how our Accouting Software can transform your organization’s financial operations. From free product demos to customization discussions, we’re here to help you take your business’s accounting needs to the next level.

Search all Fields for Specific Text

Use the Search box to search all fields of Vendor Information. Search any portion of a Vendor Name, Address, City, State, Contacts, Default Accounts, etc.

Comprehensive number of fields to Define Vendors including Address, Pay To Information, Main Contact, Default Account, URL, and Main Email Address

Vendors may have different addresses to send payments to. Separating Payment Address from Main Vendor Address is important.

Accounts Payable and Recent Transactions

View Real-Time Accounts Payable status as well as the Most Recent Bill and Payment information of Vendor.

Manage Unlimited Number of Vendor Contacts

Contact Names, Title, Phone Numbers, Email Address

Manage Credit Accounts By Vendor

Identify the Credit Card Numbers issued by Vendors along with linking the Employee that that Credit Card has been assigned to.

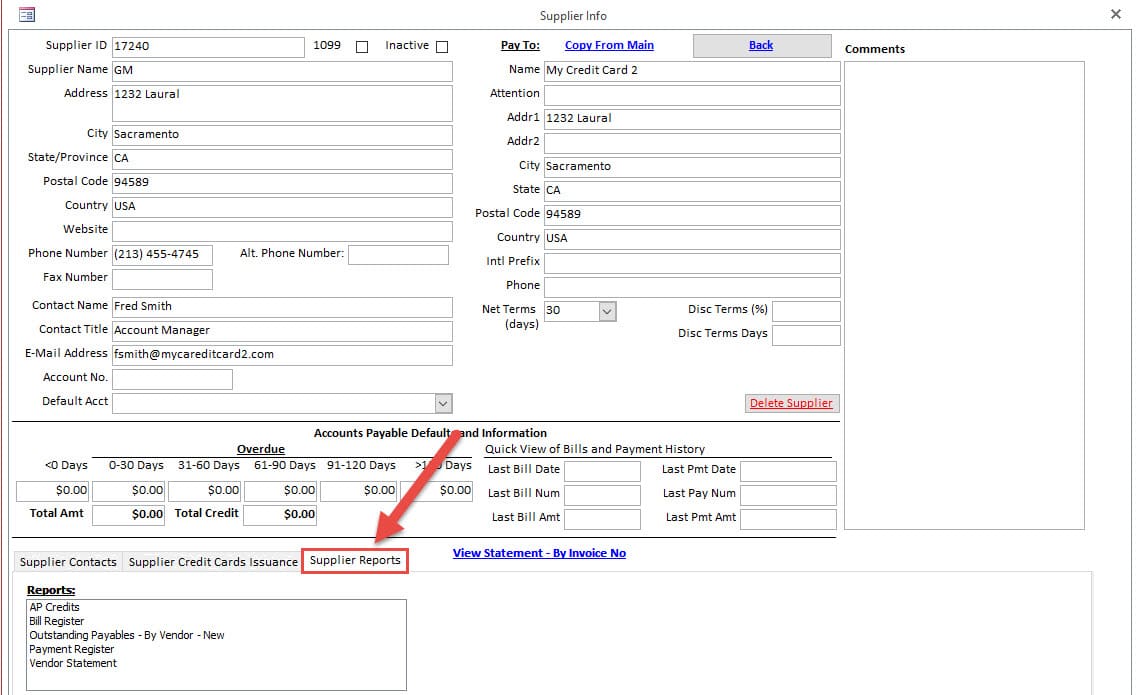

Quick Access to Most Popular Vendor Reports

Our most popular viewed reports are available from each vendor or Suppliers record, providing ease of access to vital information.

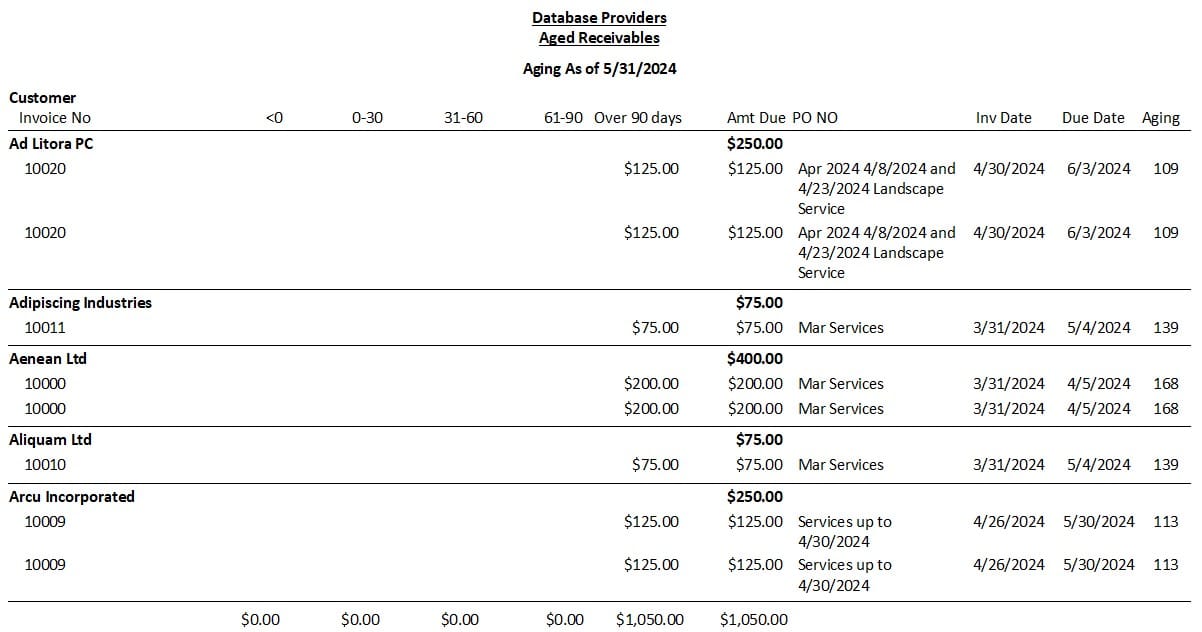

Aged Receivables

View Receivables by Customer, Aging Days, Date Period

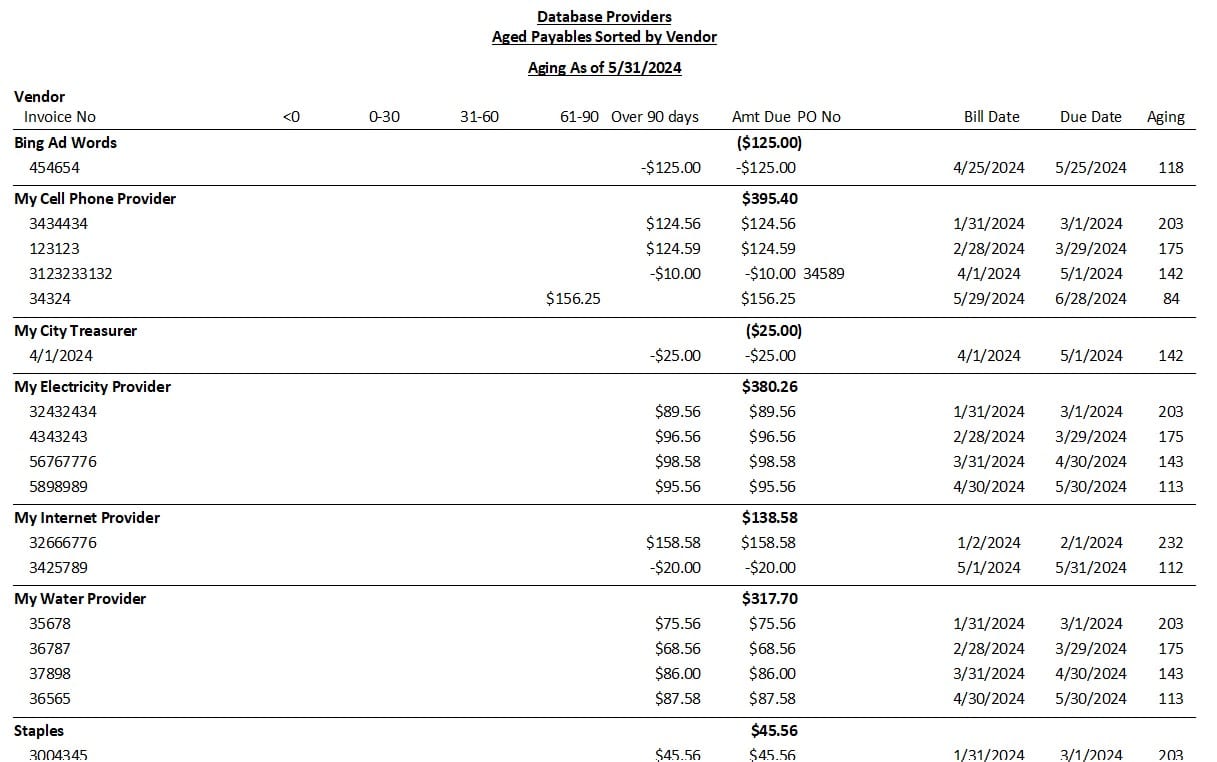

Aged Payables

View Payables by Vendor / Supplier, Aging Days or Date Period

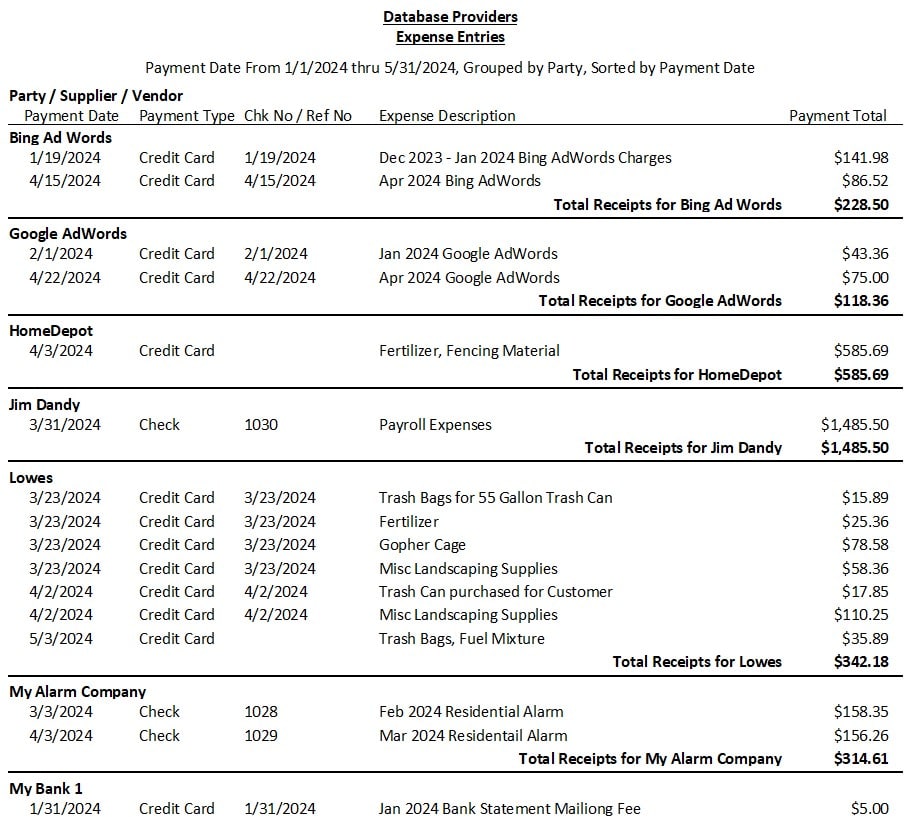

Expenses

View Expenses By Supplier, Expense Account, Date Range

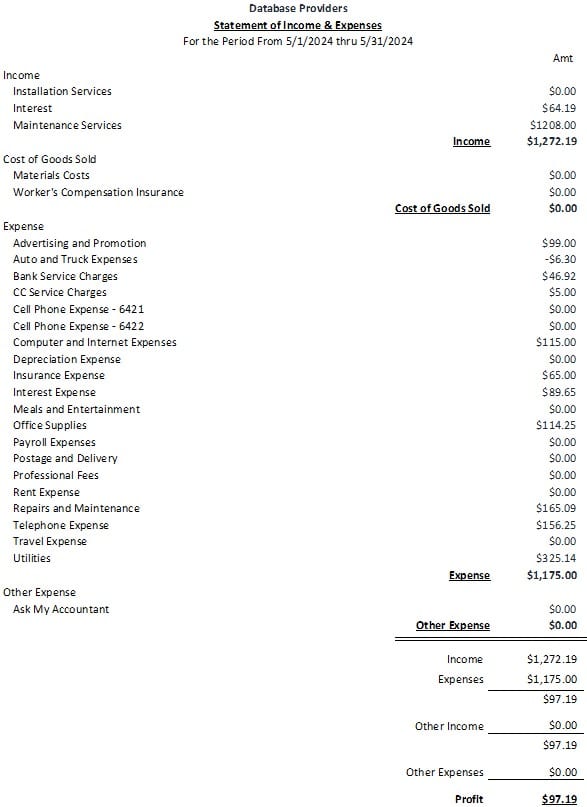

Income Statement

View Income Statement By Period, Month, Quarter, Year and Multi-Period View

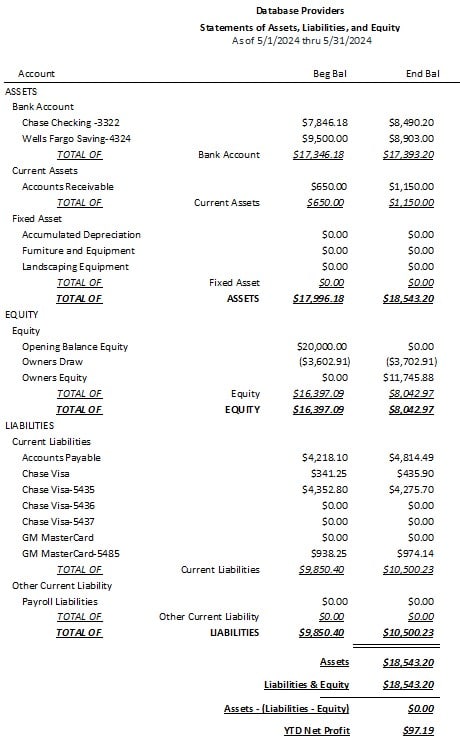

Balance Sheet

View Balance Sheet By Period, Month, Quarter, Year and Multi-Period View

Chart Of Accounts

Manage Chart of Accounts

Easily create and manage chart of accounts for enhanced and detailed accounting

- 100s of Industries to Choose From along with Business Type to Establish Default Set of Chart of Accounts

- Create Additional Accounts as needed.

- Easily Search Existing Chart of Accounts by Type.

Easily Search Existing Chart of Accounts by Type.

Revenue / Income Journal Entry

Bypass Invoicing Process with Revenue Journal Entry

Double-Entry Accounting

- Credit Payment Account – Check, Wire Transfer, Credit Card, ACH / EFT, Cash

- Debit Income Account

Expense Journal Entry

Bypass Bill Process with Expense Journal Entry

Double-Entry Accounting

- Debit Payment Account – Check, Wire Transfer, Credit Card, ACH / EFT, Cash

- Credit Expense Account – Utilities, Supplies, Business Services, Licenses, Subscriptions, Etc.

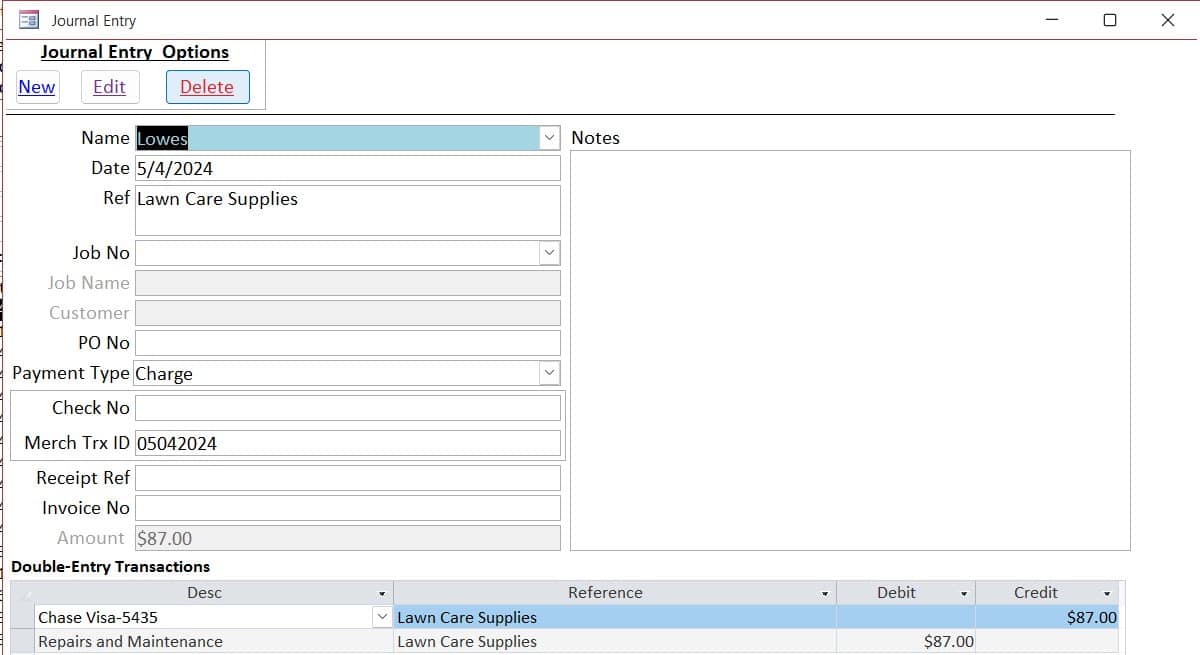

Expense With Credit Card Payment Journal Entry

Double-Entry Accounting

- Credit the Credit Card Account (Liability)

- Debit Expense Account

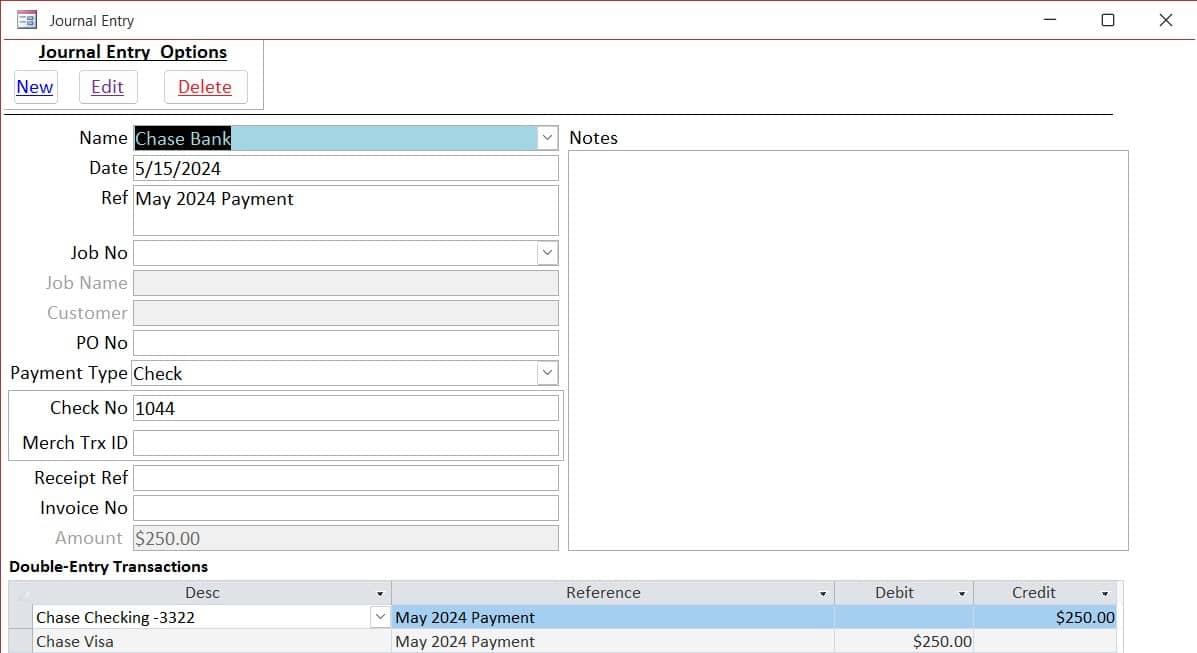

Credit Card Payment Journal Entry

Double-Entry Accounting

- Debit the Credit Card Account – Liability

- Credit Bank Account – Monies Going Out

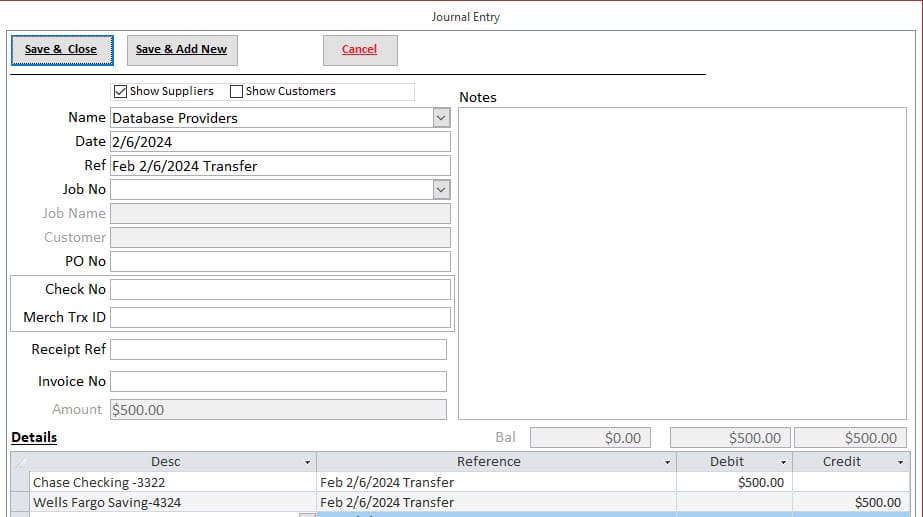

Bank Transfer Journal Entry

Double-Entry Accounting

- Debit Bank Account 1 – Monies Going In

- Credit Bank Account 2 – Monies Going Out

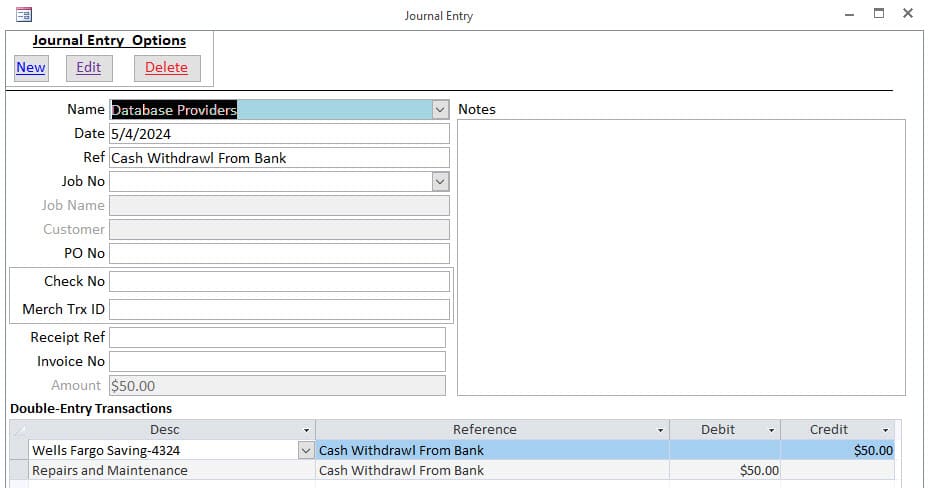

Cash Withdrawal from Bank to Expense Account Journal Entry

Double-Entry Accounting

- Debit Expense Account

- Credit Bank Account – Monies Going Out

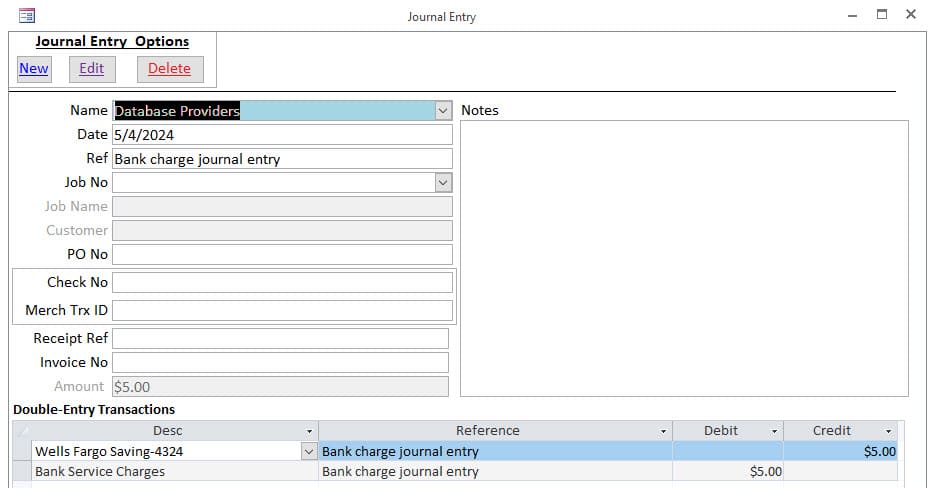

Bank Fees / Service Charges Journal Entry

Double-Entry Accounting

- Debit Expense Account

- Credit Bank Account – Monies Going Out

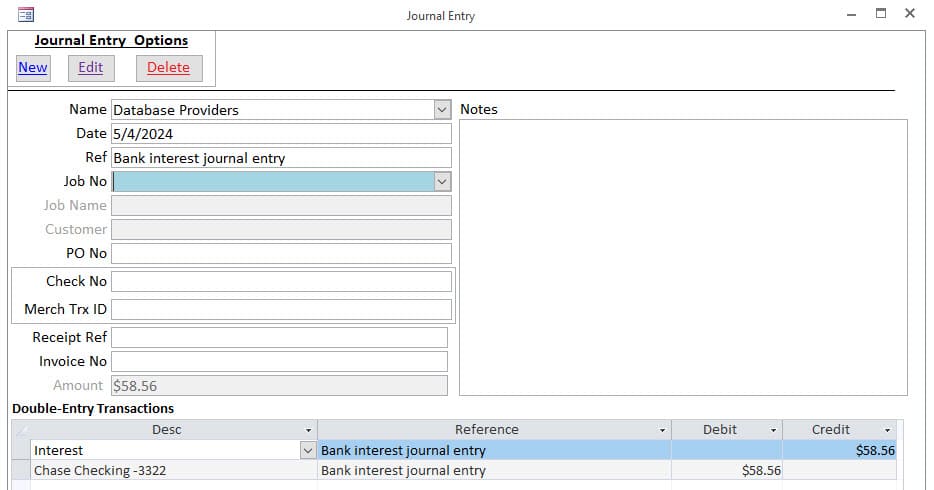

Bank Interest Journal Entry

Double-Entry Accounting

- Credit Income Account

- Debit Bank Account – Monies Going In

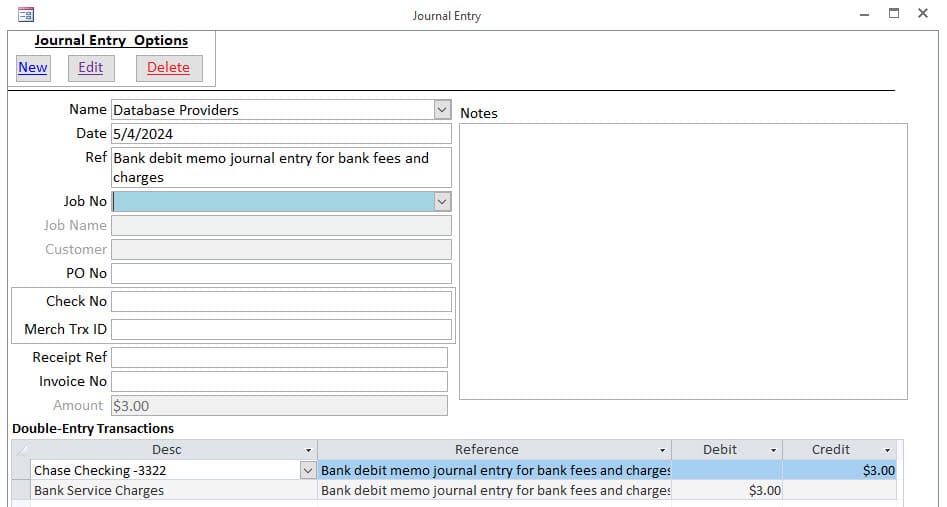

Bank Debit Memo Journal Entry

- The company’s loan payment

- The fee for mailing the company’s statement

- The fee for handling a check that the company deposited and the check was returned because of insufficient funds

- A transfer of funds to another account at the bank

Double-Entry Accounting

- Credit Bank Account – Monies Going Out

- Debit Expense Account – Increase in Monies Going In

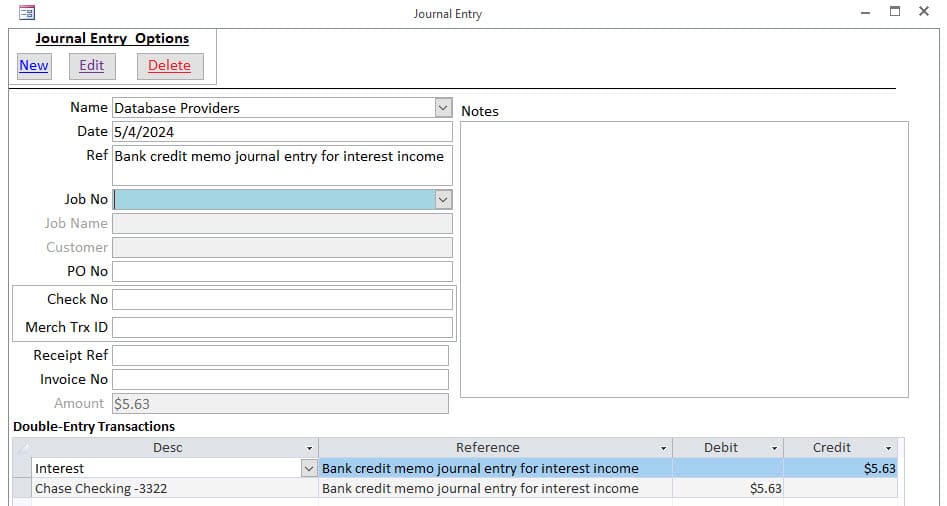

Bank Credit Memo Journal Entry

- Rectify billing errors

- Account for returned goods

- Offer a discount on future services

Double-Entry Accounting

- Debit Bank Account – Monies Going In

- Credit Expense Account – Decrease Expense Monies

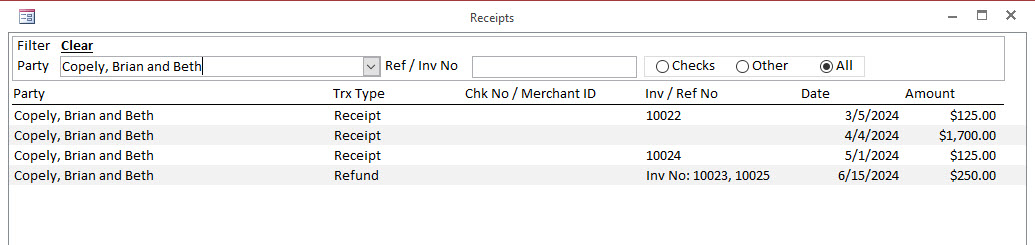

Receipts

View Receipts

Simple and Quick Process for View Receipts

- Receipts are Transactions Automatically created when recording a Receipt of Payment against an Invoice.

- Easily Search Existing Receipts by Party, Invoice Number and Payment Type.

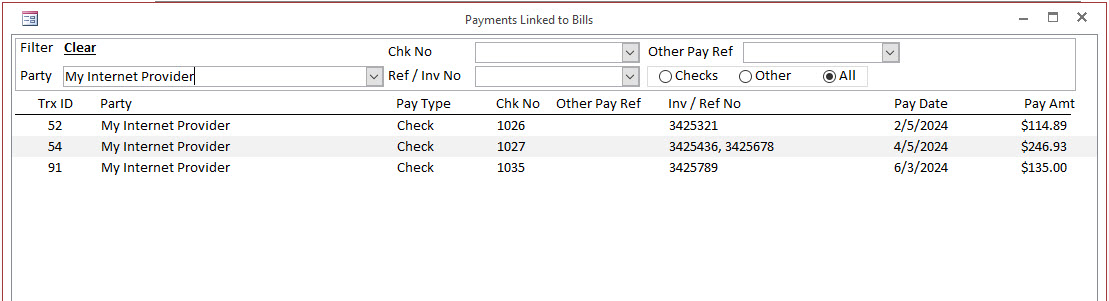

Payments

View Payments

Simple and Quick Process for View Payments

- Payments are Transactions Automatically created when recording a Payment against a Bill.

- Easily Search Existing Receipts by Party, Invoice Number, Check Number, Reference Number or Merchart Trx ID, and Payment Type.

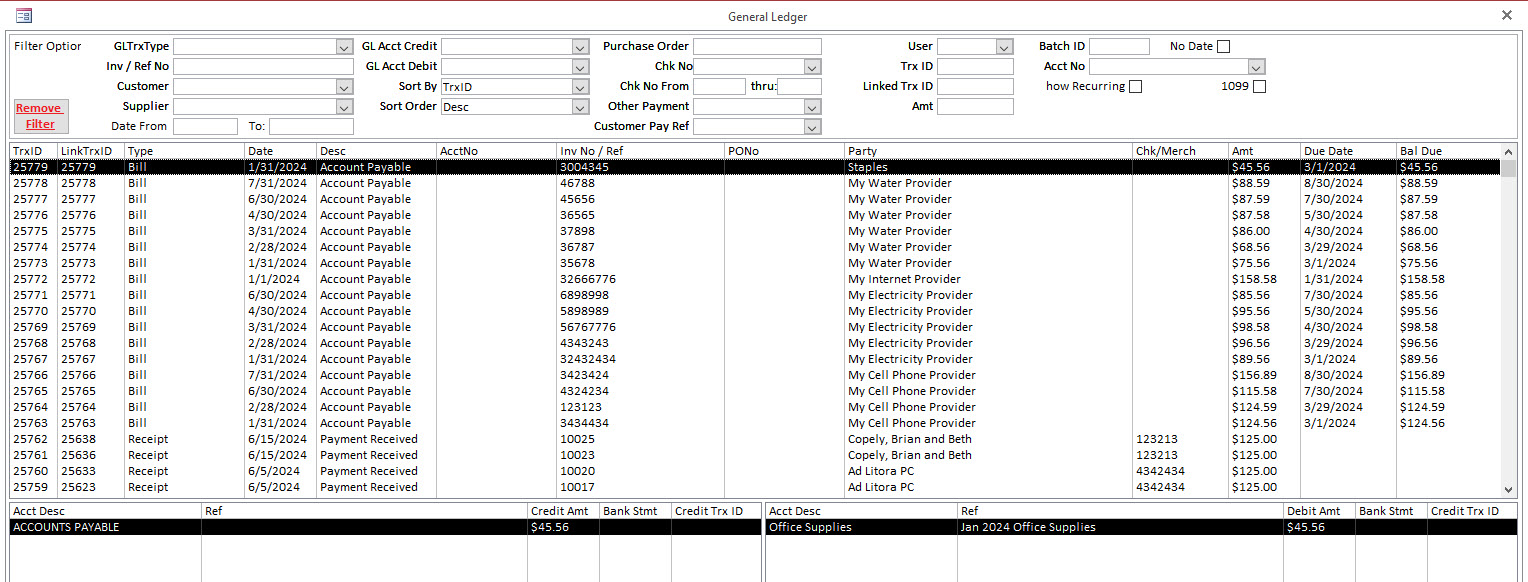

General Ledger

View All Accounting Transactions with ease!

- Comprehensive Filtering Options lets you find any Accounting Transaction Effortlessly.

- Bypass all automation and available featues and add a General Ledger or Journal Entry Tranasaction with Ease.

- General Ledger or Journal Entrues for recording transactions for Fixed Asset Depreciation, Payroll, Payroll Liabilities, Adjustments, etc.

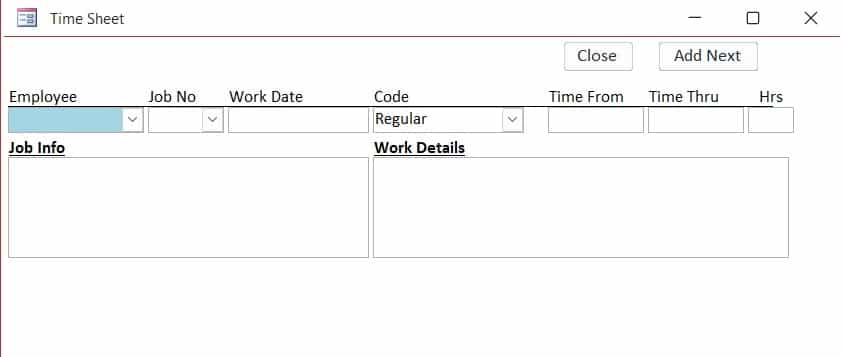

Labor Tracking / Employee Time Cards Management

Record Employee Labor Times with ease!

- Record Employee Labor Times by Pay Type.

- Manage Pay Types such as:

- Regular.

- Overtime.

- Double Overtime.

- Holiday.

- Beareavement.

- Vacation / Sick / Compensation Time / Personal Time Off (PTO).

- Unpaid Leave.

- Jury Duty.

- Flexibility to Categorize Labor Times by Job Numbers.

Labor Tracking / Employee Time Sheet Review and Processing

Review, Approve and Create Payroll with ease!

- Comprehensive Filtering Options by Employee and Work Date Range lets your Review, Approve and Convert To Payroll with Ease.

- Separate Employee Labor Tracking by Pay Types.

- Seperate Labor Tracking by Job Numbers to Generate accurate costs of Labor of each Job.

Payroll Details

Create Payment of Payroll with ease!

- Create Checks for Payroll Payment with Simple One-Click process.

Bank Account Register

View All Bank Account Transactions with ease!

- Comprehensive Filtering Options lets you find any Bank Account Transaction Effortlessly.

- Bypass all automation and available features and add a Bank Account Transaction with Ease.

- Add Deposits, Withdrawals, Account Transfers with minimal steps.

Bank Account Reconciliation

Reconcile Each Bank Account with ease!

- Comprehensive Filtering Options lets you view all Deposits and Withdrawals making the clearing process Effortless.

- Comparing the Company Balance with Bank Statement Balance is critical in this Accrual Basis Accounting Software.

- Simple Method to Add Bank Fees, Charges, Interests and other transactions during the reconciliation process.

Credit Card Register

View All Credit Card Account Transactions with ease!

- Comprehensive Filtering Options lets you find any Credit Card Account Transaction Effortlessly.

- Easily Manage Multiple Card Numbers under Single Account.

- Add Charges, Credits, Payments, Fees, Service Charges and Interest with minimal steps.

Search all Customer Fields for Specific Text

- Use the Search box to search all fields of Customer Information.

- Search any portion of a Customer Name, Address, City, State, Contacts, Bill To Addresses, Ship To Addresses and Default Accounts, etc.

Customer Main Location / Address

Seamlessly create and manage Customers for enhanced accounting

- Easily manage Customer Main Locations and Addresses

Real-time Accounts Payable view and Most Recent Bill and Payment Transactions

Customer Contacts

- Manage Unlimited number of Customer Contact Information

Customer Bill To Location and Address

- Manage Unlimited number of Customer Bill To Locations and Addresses

Customer Ship To Locations and Addresses

- Manage Unlimited number of Customer Ship To Locations and Addresses

Customer Job Numbers

- Create and Manage Job Numbers for Each Customer

Customer Notes

- Add Customer Notes to communicate with others.

Customer Reporting

- One Click to View Our Popular Customer Reports

- Effortlessly Email Customers Various Account Reports with One Click

Invoice Listing (Account Receivables, AR)

- Search and Find Invoices by using Comprehensive Filter Options.

- One click to show Invoices With Balance

Invoice Details

- Common Invoice details such as Customer, Bill and Ship To Addreses, Invoice Number, Invoice Date and Payment Due Date, Purchase Order Number, Job Number,Customer Account Number and Amount Due.

- Quick View of All Transactions linked to the Invoice.

- Quick View of any Customer Credits.

- Credit and Debit Accounts for this Double-Entry Accounting approach.

- Easily Enter Payment transaction using 5 Different Payment Options.

- One Click Options to:

- Copy Invoice,

- Delete Invoice,

- View Cusomer Record,

- View Printable Invoice,

- Email Invoice to Customer,

- Create Credit Memo,

- Apply Credit,

- Enter a Refund

- Professional Layout for Printed Invoice and Invoice added as Attachment to Email.

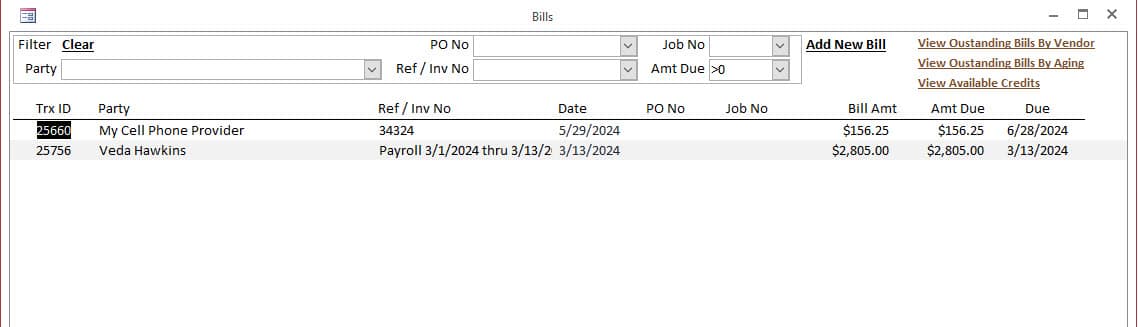

Bill Listing (Account Payables, AP)

- Search and Find Bills by using Comprehensive Filter Options.

- One click to show Bills With Balance

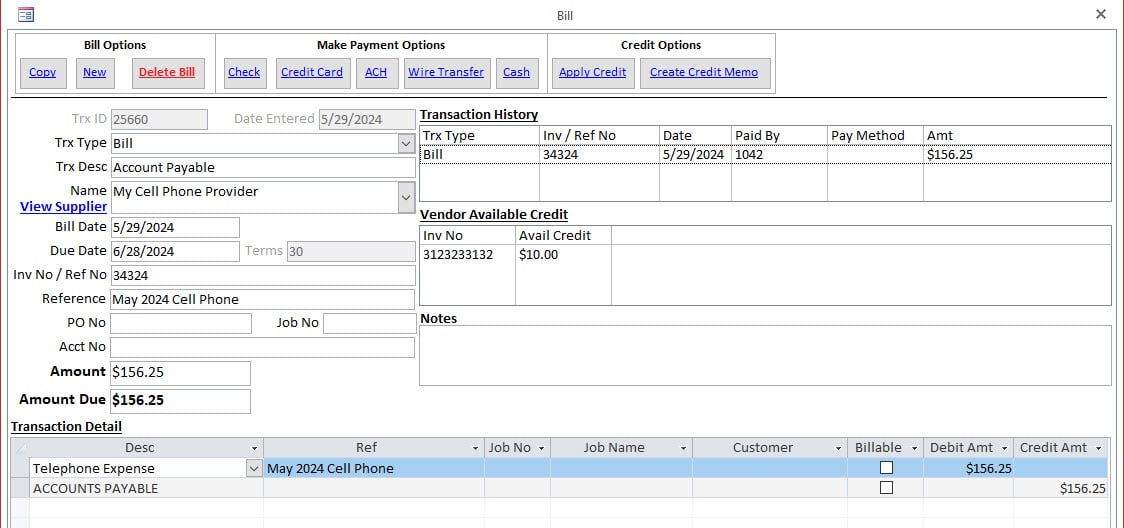

Bill Details

- Common Bills details such as Vendor / Supplier, Invoice Number, Bill Date and Payment Due Date, Purchase Order Number, Job Number, Amount Due.

- Quick View of All Transactions linked to the Bill.

- Quick View of any Vendor Credits.

- Credit and Debit Accounts for this Double-Entry Accounting approach.

- Easily Enter Payment transaction using 5 Different Payment Options.

- One Click Options to:

- Copy Bill,

- Delete Bill,

- View Vendor / Supplier Record,

- Create Credit Memo,

- Apply Credit

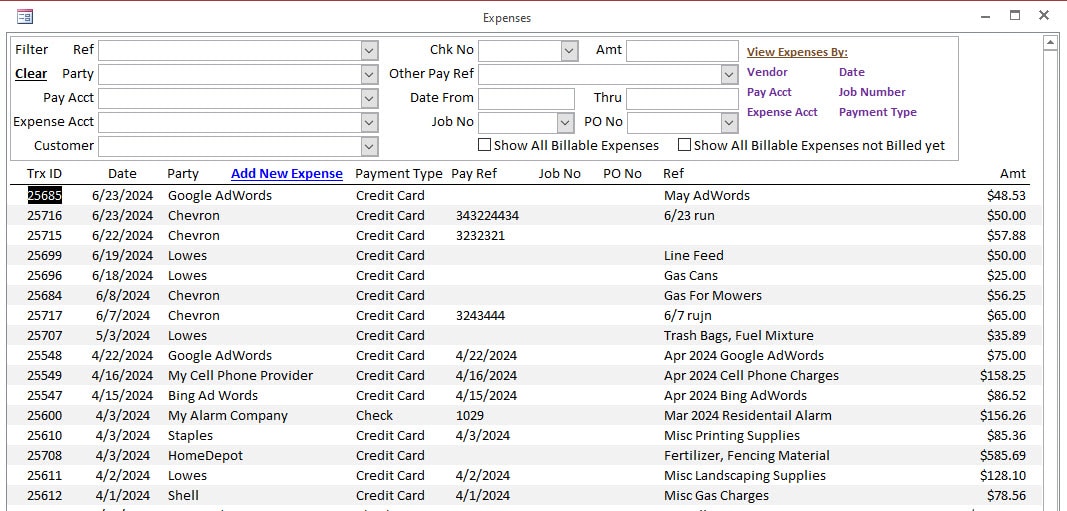

Expenses Listing (General Ledger, GL)

- Search and Find All Expenses Entered thrrough General Ledger by using Comprehensive Filter Options.

- One click to show Expense Transaction.

- Expenses Entered throgh General Ledger bypasses the Bill and Bill Payment Process.

- One Click to Display Expenses By:

- Vendor,

- Payment Account,

- Expense Account,

- Date,

- Job Number

- Payment Type

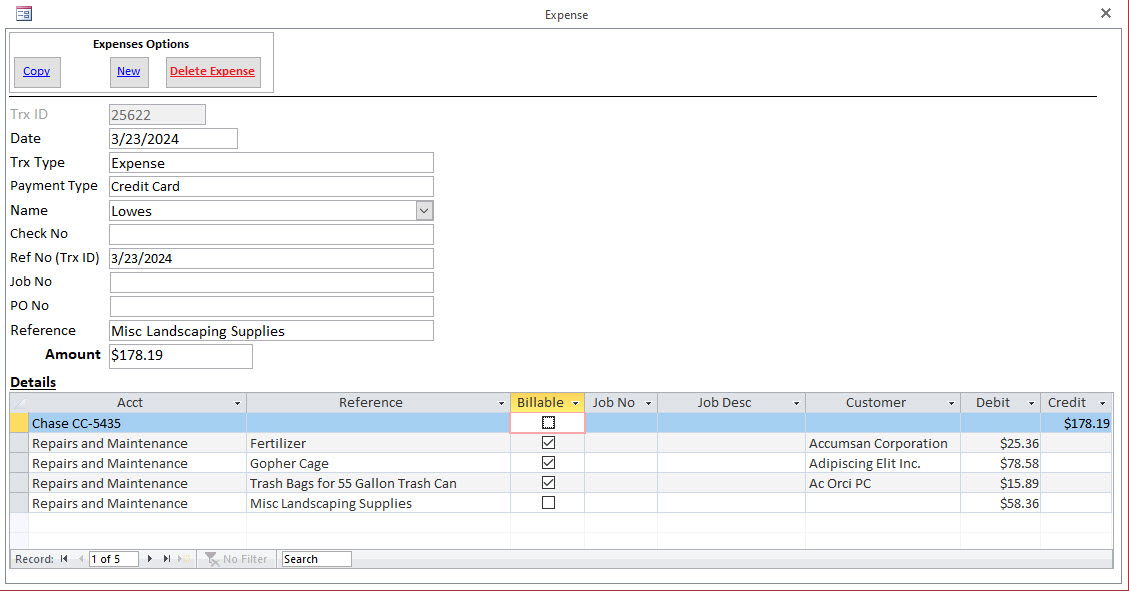

Expense Transaction Details

- Common Expense details such as Vendor / Supplier, Payment Type and Reference Detail, Purchase Order Number, Job Number, Amount Expensed

- Credit and Debit Accounts for this Double-Entry Accounting approach. Typically the Payment Credit Account and Expense Debit Account

- Each Expense Contains Reference Detailing the Expense Item, Job Number, Customer, Whether Billable to the Customer and the Debot or Credit Amount.